3 min read

The secret no one’s telling you about your EMI scheme

Naveed Akram

:

Updated on December 3, 2025

Naveed Akram

:

Updated on December 3, 2025

This article is more than 7 years old. Some information may no longer be current.

We talk to a lot of business owners about Enterprise Management Incentives (EMIs) at Vestd.

And there is a surprising misconception that often comes up when they’re calculating the costs of their share scheme. The challenge is they are usually focused on the price of the option agreement document. What many don’t appreciate is the secret they are often not told:

It’s estimated that almost 50% of EMIs aren’t compliant when it comes to exit.

So what's going on?

The document isn’t the whole story.

The problems stem from a combination of too many cooks plus human error; things like calculation mistakes made by incorrect formulas in spreadsheets and vesting schedules, admin not being completed correctly or not on time, valuation inaccuracies, missed submissions, incorrect clauses buried deep in legal docs and a host of other things.

That’s why so many people overpay in professional fees and tax unnecessarily.

Why is non-compliance such a problem?

The whole reason you are investing in an EMI scheme is to give your employees a tax-efficient way to participate in sharing ownership in the company. And you want the company to benefit from that alignment in interests.

Luke Fisher, the CEO of Mo (formerly ThanksBox) sums it up nicely:

“It feels natural that our people are invested in our success. The founders are passionate about people being invested in the company to change the way they think and act — as a shareholder, not simply an employee.”

If your scheme isn’t compliant when employees come to see that value, there is going to be a huge gap between what was promised and what they’ll actually receive.

We see huge amounts of money being spent trying to retrofit mistakes that were made years earlier because shortcuts were taken or things simply fell through the net as no single person owned the scheme management (or understood what was involved).

This broken flow is due to many owners

The agreement document is traditionally generated by your lawyer. The valuation by your accountant. The submissions to HMRC by the CEO or CFO.

And then you have to decide, who is going to:

- Pick up the annual notifications and updates to HMRC?

- Keep an accurate record of what’s been issued and what’s left in the pool?

- Fulfil filing obligations at Companies House?

- Take care of share authorisation, board resolutions and approvals?

- Ensure new people are added correctly and leavers are processed compliantly?

- Stay on top of vesting schedules, employees exercising their options, the list goes on...

The truth is, coordinating all this tends to sit on the CEO/CFO's shoulders and most don’t appreciate what’s involved until after they get started. They believed the price they paid for the doc included all this.

Unfortunately, it doesn’t.

And of course, they are busy, dealing with the demands of the business so they end up constantly forking out cash in professional fees to plug these gaps over the lifetime of the scheme.

The cost of that initial doc actually becomes quite irrelevant when you consider the lifetime costs which we often see racking up into the tens of thousands of pounds when all’s considered (not to mention their valuable time spent coordinating it all).

Scouring the internet for the cheapest EMI template is incredibly short-sighted. When the aim is to exit with a compliant scheme and happy employees, you want to get it right. It’s why we provide the doc for free to customers.

You can see the headache this creates for CEOs/CFOs, especially when a business owner might only do this once in a five to ten-year period. Trying to learn all the ins and outs, the ever-changing policies and criteria become at worst unrealistic, and at best simply inefficient.

With responsibility spread over complex tasks, multiple people, paper documents and Excel/Google docs, it's understandable to see why things can slip and errors are made.

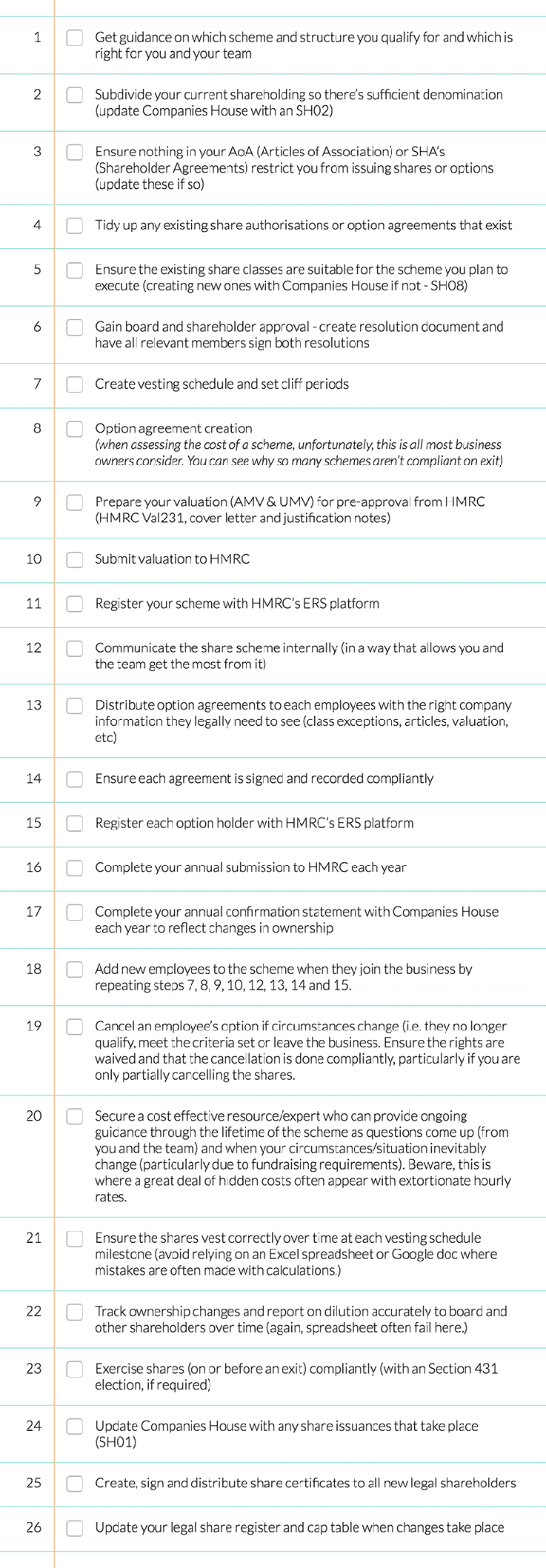

Managing an EMI scheme involves more than an option agreement

Imagine if you had what no one’s been sharing with you. A full list of all the things you’ll need to consider for the lifetime of your scheme. So you can fully appreciate what’s involved, protect your business, and your employees and stay compliant through the journey.

So you can feel fully informed when you speak to your professional service advisor and can understand where they have you covered and where there are gaps. And, most of all, so you can get a realistic estimate of the total costs involved to see the scheme through to exit.

My intention is that by providing the below checklist, you’re less likely to be misled by someone only interested in selling you the agreement document. Or an overpriced valuation. Or an Excel template. You get the picture…

Your free EMI scheme checklist

Here's a complete checklist to get you on the right track.

I hope that’s been helpful. You can also download a PDF version here.

Save money and time with Vestd

If you’d like to understand how you can set up your share scheme and eliminate all the workload above, whilst reducing your costs significantly, talk to our share scheme specialists.

Our team of share scheme specialists would be happy to give you a no-pressure demo of Vestd and explain how we use software to save you the headache and keep you compliant.

Meet with Vestd

What to do with your shares or options

Last updated: 1 October 2024. Your company has offered you shares or share options. Great! Though you might be wondering: now what? What’s really in...

You want to set up a share scheme, but is your cap table even ready?

You’ve asked the big questions and you’ve decided that setting up a share scheme is the right decision for your team and the business.