How to mobilise your cap table

As a startup, getting investment is key. After all, it takes more than a winning idea to grow a successful business. Unless you plan to fund your...

Manage your equity and shareholders

Share schemes & options

Equity management

Migrate to Vestd

Company valuations

Fundraising

Launch funds, evalute deals & invest

Special Purpose Vehicles (SPV)

Manage your portfolio

Model future scenarios

Powerful tools and five-star support

Employee share schemes

Predictable pricing and no hidden charges

For startups

For scaleups & SMEs

For larger companies

Ideas, insight and tools to help you grow

5 min read

Robert Mitson

:

Updated on May 3, 2024

Robert Mitson

:

Updated on May 3, 2024

Last updated: 3 May 2024.

When starting a business, some of the more administrative tasks, such as managing your cap table, might not always be front of mind.

When in the throes of passion projects, as ideas flow, maintaining how your newly formed company tracks ownership might seem a little dry by comparison.

As your company scales, this kind of work may still not make it to the top of your to-do list.

Nevertheless, it is incredibly important to have an accurate view of your ownership structure and will become more so as you position the company for a funding round or acquisition.

In this article, we will unpick the concept of cap tables to help you understand what they are, the different ways that they can be maintained, and some of the most common mistakes that we see.

We will also provide you with a free cap table template - although after reading this, we’re not convinced that you’ll want to use it.

A cap table (short for ‘capitalisation table’) shows the equity ownership of a company. This includes different share classes, such as ordinary shares and preference shares (or ‘prefs’), the price paid, and the details of who they belong to.

As such, a cap table is a quick and easy way of seeing an individual’s percentage share of a company and what it’s worth. Ultimately, a cap table should provide this information at a glance.

A cap table is by no means static.

It needs to be updated every time the ownership of the equity in your company changes. For example, when awarding equity to a newly hired employee or raising a round of investment.

Our Cap Table Management guide goes into a lot more detail. Grab your free copy.

Cap tables are generally straightforward in the early stages when your headcount doesn’t change frequently, but things become exponentially more complicated as you scale.

Let’s consider the different ways that businesses can manage their cap tables.

Some of the solutions available to manage cap tables include:

*Preferably a full equity management platform, and one integrated with Companies House for total accuracy.

In our experience, the vast majority of organisations use a spreadsheet to manage their cap tables.

Nine times out of 10, the cap tables we see are broken in some way.

Indeed, that’s why we’ve created a cap table template, to help these organisations to do it better.

An early-stage startup with two founders might not need a purpose-built solution to manage their cap table. In these companies, understanding and keeping track of the nature of ownership is relatively straightforward.

Now consider a scaling startup with 20 or more employees. Each time a new employee joins and is awarded equity (whether options or shares), changes need to be made.

Every time the company valuation shifts, changes need to be made. And what about each time you receive investment? You guessed it: changes need to be made.

This can become very complicated very quickly, and the costs of getting it wrong are significant. Unwinding a mismanaged cap table can be very costly in terms of time and money.

Usually, these problems aren’t noticed until a company is getting ready to raise funding, and then require hours of lawyers’ and accountants’ time in order to try and understand where the errors lie. Ouch.

Spreadsheets certainly serve a purpose, and as previously mentioned, in the early stages of your company it might make sense to use spreadsheets to keep track of the ownership of your company.

However, the following are four examples of when using spreadsheets is a terrible idea:

Yes, spreadsheets are fine to begin with, but they start to create problems as you scale. The formulas required for spreadsheets to do their job can break as an increasing number of inputs are added, and the potential for human error grows too.

Recognising this early on is vital as it will help you to select a dedicated tool to manage your equity as your business grows.

If you are sharing ownership with your employees, NEDs and partners (team), and new team members are joining regularly (and no doubt some may leave), then you should definitely avoid using a spreadsheet to manage your cap table.

In these situations, a purpose-built solution is advisable, to allow you to keep track of ownership as your team grows, while remaining compliant with Companies House filings.

The world of startups is an uncertain place, and as such, there are myriad reasons why you might want to model different scenarios.

Taking investment is a great example of this: scenario modelling will help you to understand the impact of different rounds of investment on the ownership of your company.

But where is the sense in creating sophisticated models when you are relying on inaccurate management information? More about this later.

If you are planning on going through rounds of investment, then maintaining cap tables through a spreadsheet isn’t a good idea.

External investment will bring a fresh set of challenges in terms of equity management: there may be different share classes, dilution, changes to existing ownership structures, and plenty of other administrative headaches.

In this case, you will want to graduate from spreadsheets quickly, in order to keep track of the growing complexity of your company’s ownership.

We help a lot of businesses to manage their equity and we have seen pretty much every mistake you can imagine (although I’m sure there are new ones being created as I write) when it comes to cap tables.

In many cases, these errors can be very difficult to make sense of, and require a lot of time, effort, and money to rectify.

Let’s take a look at some of the most common cap table mistakes, so that you can hopefully avoid them before it’s too late. These include:

Spreadsheets have a nasty habit of rounding figures. In some cases this can be helpful, but certainly not in the case of your company’s cap table.

In the early stages of your business, this may not lead to significant problems as the rounding errors will likely be small and easy to trace. However, as a business grows these rounding errors begin to stack up.

In nearly every instance we have seen, where spreadsheets are involved, so too are rounding errors. We find that more than half of businesses going through funding rounds have incorrect cap tables, and rounding errors are often to blame.

Spreadsheets can become complicated very quickly.

In order for a cap table in a spreadsheet to do everything that companies need it to do, they need to have a level of complexity that is difficult to manage - especially as your business grows.

In our experience, this complexity often leads to human errors - especially when it comes to filing with Companies House and HMRC. When using spreadsheets, this is a manual process, and by its very nature, increases the propensity for human error.

We often encounter instances where some information simply has not been filed at all, such as sub-divisions or the elusive shares issued for initial investment by friends or family. This means that your company’s reality is not reflected truly at Companies House.

Another common mistake that we come across is inconsistencies between internal management information, and the information that is filed with Companies House.

This can include company valuations, share allocations, nominal values, and plenty of other information, which can cause a real headache for founders.

Many of these mistakes are caused by companies by using a cap table that isn’t appropriate for their business.

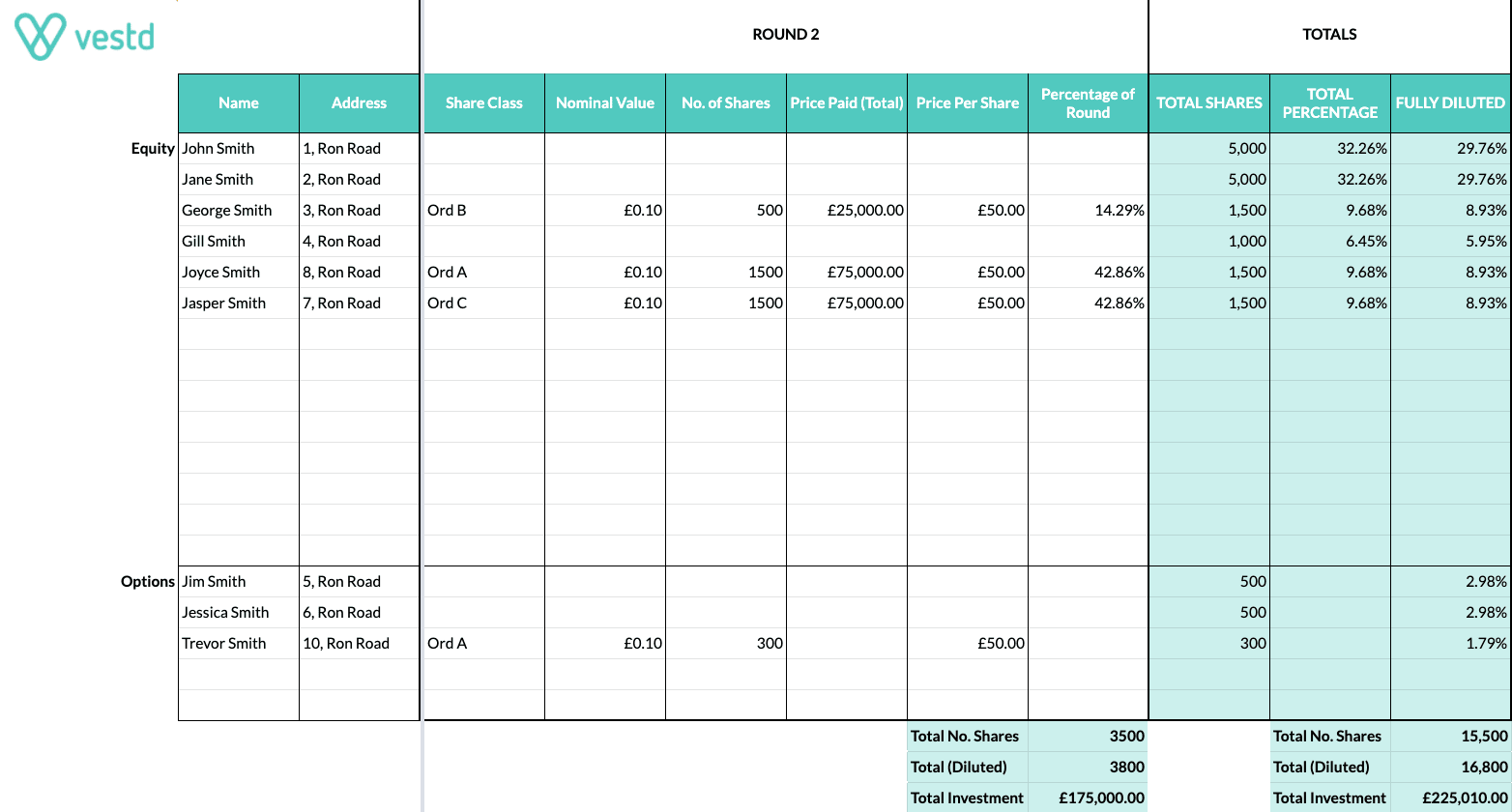

So, as promised, here’s a simple cap table in spreadsheet form that you can use to track ownership. It is intended for non-complex companies.

As your business scales your ownership structure and equity management requirements will inevitably become more of a headache if you do this manually.

You can get your very own digital cap table with Vestd for FREE. Discover our free plan today. Once you go digital, you won't go back!

If you later decide to upgrade to one of our share scheme plans, our experts will perform a cap table health check to make sure everything's in order.

As a startup, getting investment is key. After all, it takes more than a winning idea to grow a successful business. Unless you plan to fund your...

Last updated: 19 April 2024 Capitlisation tables (cap tables) demonstrate much more to potential investors than just a snapshot of your company’s...

Last updated: 16 October 2024.