What vesting schedule is right for your EMI share scheme?

Last updated: 17 April 2024 When you award options to an employee as part of an Enterprise Management Incentive (EMI) scheme, they don’t become...

Manage your equity and shareholders

Share schemes & options

Equity management

Migrate to Vestd

Company valuations

Fundraising

Launch funds, evalute deals & invest

Special Purpose Vehicles (SPV)

Manage your portfolio

Model future scenarios

Powerful tools and five-star support

Employee share schemes

Predictable pricing and no hidden charges

For startups

For scaleups & SMEs

For larger companies

Ideas, insight and tools to help you grow

So, you’ve discovered the Enterprise Management Incentive (EMI), the most tax-efficient employee share option scheme in the UK. Nice!

By default, EMI options aren’t immediately available on the award. Instead, employees earn their options over time, they ‘vest’, and so we call it time-based vesting.

Once a vesting schedule is complete, employees can exercise all of their granted EMI options. ‘Exercise’, by the way, is just a fancy way of saying ‘convert into shares’.

But if an employee leaves before the vesting schedule is complete, you can decide whether they keep or lose the options they’ve earned up until that point.

Generally speaking, we say let them keep that which is vested, which seems fair, right?

That conditionality is a huge advantage because it means you can give your team their just deserts (a piece of the pie) and protect the business at the same time.

Now… You can also set additional conditions centred on performance. You can see the appeal; it’s one way of incentivising an employee to meet a sales target, for instance (or so you might think).

But I’m about to let you into a little secret: attaching lots of conditions to your EMI scheme isn’t the best idea. I’ll explain why that is, but first, let’s quickly go over what vesting is and what it means for your EMI scheme.

A vesting schedule determines when and how an employee can earn their EMI options. It’s as simple as that, but as you’ll see, very easy to overcomplicate. To cut a long story short, there are five routes you can go down when designing yours:

EMI options can vest monthly, quarterly, biannually or annually.

Annual vesting is quite common. In practical terms, for employees, that usually means their options vest on the anniversary of the day they joined, like a reward for every year of service.

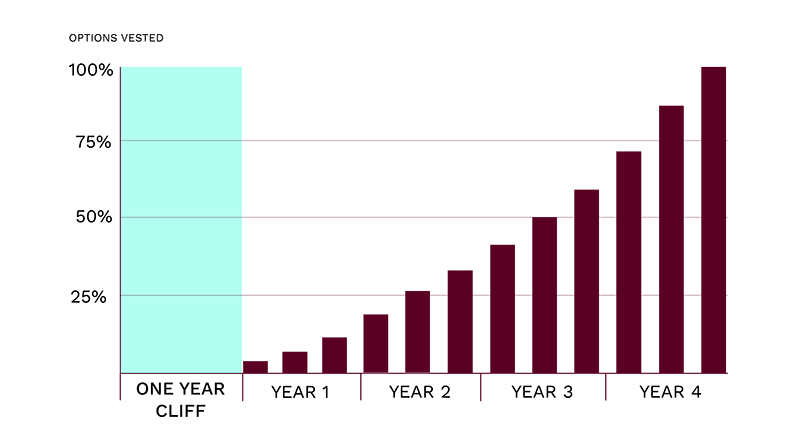

A typical vesting schedule is between three to five years. Usually with a one-year cliff, which leads nicely onto the next point.

A cliff is the amount of time that must pass before any options can start to vest, after which they do so on a set schedule. A period of nothing before something.

A common example is a four-year vesting schedule with a one-year cliff.

If an employee is going to leave, it’s likely they’ll leave within the first six to 12 months. So, if you add a one-year cliff and the employee leaves within that first year, they leave with nothing.

You can also ‘back-weight’ or ‘back-load’ vesting. So instead of evenly distributing the options over time, you can award employees a greater percentage of their allocated options in the later years of their employment.

You can outline performance-based milestones to meet before all or any of an employee’s EMI options vest. For instance:

An example in action: let’s say you set ARR targets for your Head of Sales. If they hit £250,000 ARR then 25% of their options will vest. If they do exceptionally well and hit the top target of £1,000,000 then 100% of their options vest.

If you’ve already promised someone options, and want to deliver on that promise right away, those options can immediately vest. While this is rare, it is possible. And you still get to have the final say on whether they can exercise those options right away or have to wait.

Our founder and CEO Ifty Nasir has written a guide to EMI vesting schedules which covers all of these points in more detail, so do check that out.

You'll probably hear the words 'exit-only' and 'exercisable' when designing your EMI scheme, so I'll quickly explain.

If you only want EMI options to be available to employees following an exit, in other words, when the company is acquired or sold, then an exit-only scheme makes sense.

If you’re not sure what the future holds and you want to give option holders the ability to become shareholders sooner then an exercisable scheme is ideal. If you chose an exercisable scheme, then they can request to exercise after each tranche vests.

If you go with exit-only, option holders can only exercise their options following an exit event, regardless of whatever vesting schedule you've set.

For example, you could design a four-year vesting schedule but stipulate that option holders can't exercise their EMI options until the business is sold, which might happen a few years after those four years are up.

Ifty weighs up the pros and cons of exit-only and exercisable EMI schemes here.

Time-based vesting is the most common approach and for good reason. Time-based vesting schedule with a cliff? Well, that's even better. Why?

If a vesting schedule commences on the date an employee joined the company, who can argue with that? It’s clear to that employee where they stand and what they seek to gain if they stick around long enough.

It’s also super simple to set up in our scheme designer. And option holders will get an email notification every time their options vest - which if you’ve set to vest annually on their work-versary - is a nice little perk to celebrate another year of a job well done!

We’ve seen thousands of EMI schemes in our time, and the best include time-based vesting and a cliff. Wondering what else a great share scheme contains? Download our free guide to find out.

Moving on...

Attach too many performance conditions to your EMI scheme and you run the risk of:

You want your EMI scheme to be as easy to understand as possible, totally unambiguous and fundamentally, fair.

Challenge employees to hit ten goals and the prospect of hitting them all will feel impossible. Equally, lofty goals are hard to measure and even harder to achieve, in that case, where is the incentive for the option holder?

Even if an employee is on track to meet a target, what if the unexpected happens? E.g. The economy takes a turn or the employee falls ill. Suddenly, that target is unattainable and through no real fault of their own.

And then there’s a slight risk that an option holder will do whatever it takes to meet the milestones, even if that doesn’t sit well with your workplace culture.

Now, one way to avoid this trouble is to set collective goals for the team rather than individuals. That’s entirely possible and easy to set up with Vestd - you won’t need to set up specific schemes for every individual.

But arguably, there are other ways to incentivise key people to hit targets. That’s what commission or a cash bonus is for right?

Before we recap, let’s think back to why you’re setting up an EMI scheme in the first place.

You want to give your team a piece of the pie, a slice of the action, a future share in the company’s success that they helped to create.

And in turn, they’re more inclined to see the mission through to the end and support each other along the way. That’s the power of the Ownership Effect for you.

But if you introduce an EMI scheme with a super complex vesting schedule and loads of strings attached, the message behind it is sort of lost. And few will feel inspired.

Equity is a mighty-fine motivator, but only if used wisely. So to unlock its full potential and maximise engagement - keep your EMI scheme as simple as you can.

There are so many ways to tailor your EMI scheme to suit your business needs and that includes designing your ideal vesting schedule. And if your goal is to encourage retention, make time-based vesting a part of that.

If there’s one key takeaway, let it be this - keep it simple. If you do choose to set performance conditions, make them specific, tangible and measurable. And ideally, keep the number of conditions to a minimum.

If after reading this, you still feel a little lost, speak to a share scheme specialist. They’ve helped thousands of founders design the EMI scheme of their dreams.

And in the meantime, why not download our complete guide to EMI? It covers everything you need to know.

Learn all about the UK's most tax-efficient share option scheme.

Last updated: 17 April 2024 When you award options to an employee as part of an Enterprise Management Incentive (EMI) scheme, they don’t become...

Last updated: 16 April 2024 If you’re planning to start an EMI share options scheme for your business, one of the first decisions you’ll need to make...

Last updated: 2 October 2024. So, you want to reward your team. You might be thinking that an end-of-year cash bonus is the best option. After all,...