Exercisable vs. exit-only: which is best for my EMI share scheme?

Last updated: 16 April 2024 If you’re planning to start an EMI share options scheme for your business, one of the first decisions you’ll need to make...

Manage your equity and shareholders

Share schemes & options

Equity management

Migrate to Vestd

Company valuations

Fundraising

Launch funds, evalute deals & invest

Special Purpose Vehicles (SPV)

Manage your portfolio

Model future scenarios

Powerful tools and five-star support

Employee share schemes

Predictable pricing and no hidden charges

For startups

For scaleups & SMEs

For larger companies

Ideas, insight and tools to help you grow

5 min read

Ifty Nasir

:

Updated on October 1, 2024

Ifty Nasir

:

Updated on October 1, 2024

Last updated: 17 April 2024

When you award options to an employee as part of an Enterprise Management Incentive (EMI) scheme, they don’t become available to them immediately.

Equity isn’t awarded to employees before their contribution to your company has been made. To keep everything fair in the event that circumstances change. And give you peace of mind.

Any options you award go through a vesting period. This period allows them to gain their full value over time.

Vesting prevents options from gaining further value in the event of a shareholder leaving the company or not meeting their agreed-upon goals.

As the owner, you define when and how options vest. Doing so:

In this article, we’ll walk you through the definition of a vesting schedule and show you what vesting usually looks like for EMI schemes in the UK.

This will ultimately help you make decisions about the variables you set for your vesting schedule.

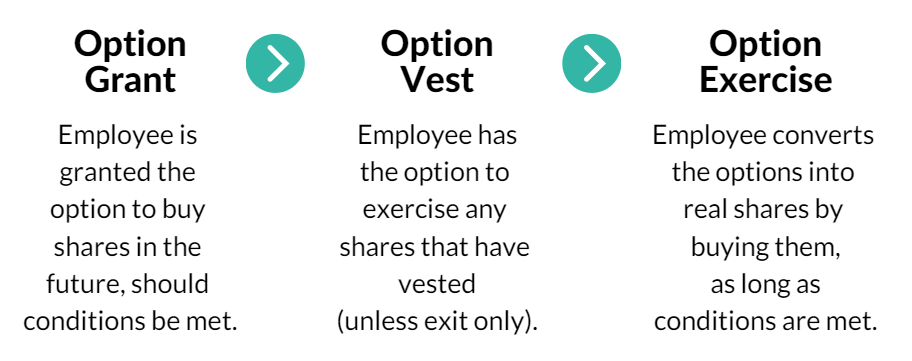

When options are granted to an employee, they typically do not become available all at once. Instead, they “vest,” allowing the recipient to slowly gain their rights to them.

A vesting schedule determines when a shareholder has the right to exercise the options they have been awarded as part of a share scheme, as well as when those options will obtain 100% of their stated value.

With an EMI scheme, an employee has the right to exercise their options either upon exit (typically the sale of your company to another) or completion of the vesting schedule.

This means the shareholder is now able to purchase the options they have been awarded. This purchase is done using the exercise price of the options.

This is what the process looks like, from grant to exercise:

Now that you have a better understanding of their usage, let’s look more in-depth at when vesting is used, and why vesting schedules are necessary as part of granting options in the UK.

As you grow and potentially obtain external funding or investors, you may issue them ordinary shares. These shares, typically used when an investor invests cash in the business, are not subject to vesting as they are real shares, not share options.

Employees who obtain options from you, however, will be subject to a vesting schedule. Employees who are given the right to purchase shares via options must gain that right over time.

They are expected to do so over a set period of time (that is, the vesting period) during which their loyalty and contribution to your company will be demonstrated. Their investment in you is rewarded in the form of fully vested options.

It is very rare to award options to employees without vesting.

You may consider exceptions if your share scheme is being started several years into the life of the company, and if there are those who have made significant contributions deserving immediate equity.

However, you still may want to consider using a cliff or a backloaded vesting schedule rather than an immediate award.

The first decision you must make is, whether you want your issued options to become shares on exit only. An “exit” may be defined as your company’s sale to another or some kind of management buy-out.

With this option, your team will work hard toward the inevitable goal of an exit, so that you may all share in the same success.

With exit only, the only way that issued options will become shares is in the event of an exit. Once the exit occurs, the issued options are converted into shares, and employees are able to sell them immediately.

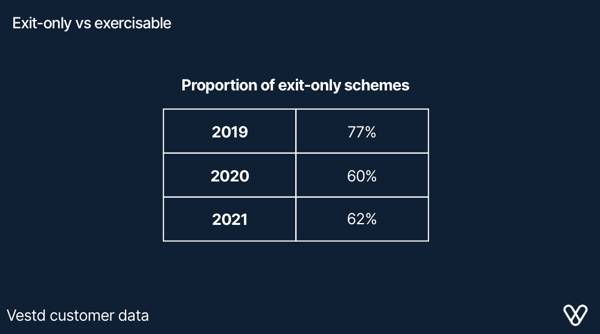

62% of Vestd customers opt for exit-based vesting, making it a popular option among customers utilising an EMI scheme.

However, it is certainly not the only option available, and may not be suitable if you have no plans to sell your company.

There are various factors to consider when designing a vesting schedule.

The variables in the schedule you use will depend on several factors, including how soon you want shareholders to obtain vested portions of their options, and whether or not you are preparing for an exit.

Let’s explore a few different variables for your EMI scheme’s vesting schedule in-depth.

If you do not want to opt for exit-based vesting, you can instead set a timetable for your issued options to vest. This is called time-based vesting, and it requires you to determine the rate at which your issued options vest.

Different vesting rates may have an impact on the behaviour and earnings of your employees.

For example, if options vest monthly over a four-year period, an employee considering departing your company may know that when they leave, they will still have the right to purchase a certain amount of shares.

In a survey of Vestd customers, we found that the following vesting frequencies were most popular:

You can base the vesting of options solely on the performance of an employee, the company itself or in combination with time-based vesting. This is known as performance-based vesting.

This option may be most attractive for specific roles where you plan to use options (or a more significant equity stake) as a bonus on top of their salary.

The only way an option holder subject to this vesting schedule will receive their shares is if they (or the company) meet the milestones you set.

These milestones might be something like:

It is possible to utilise performance-based vesting with some employees, and a simple cliff-based schedule with others.

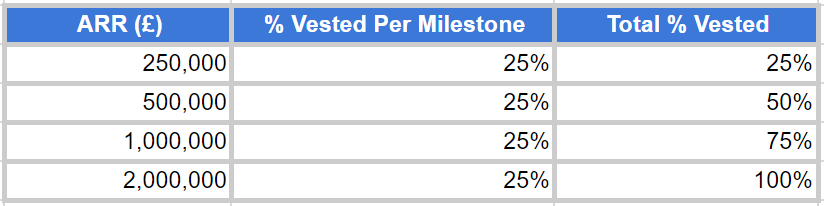

Performance-based vesting might be based on an individual’s performance and how it contributes to the company’s revenue or sales goals.

For example, a sales director’s vesting might only begin upon ARR reaching specific amounts. The per cent vested would increase on these same terms:

Only 20% of Vestd customers use performance-based vesting criteria for their employees at this time.

Finally, if you’ve done any research on vesting schedules prior to now, you may have already read about the “cliff.”

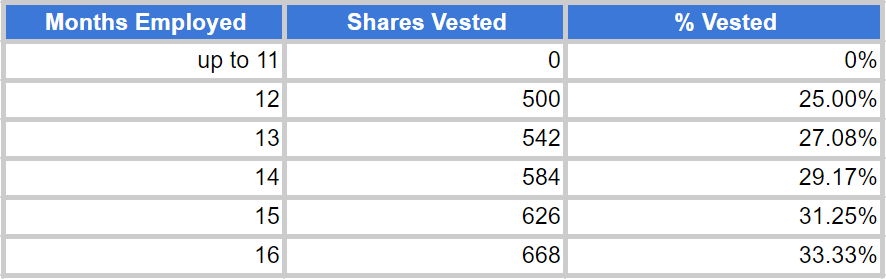

You usually see this expressed as something like “four-year vesting with a one-year cliff.” In this scenario, the "one-year cliff" refers to a period of employment that must be completed before any options are vested.

Since the early stages of a company are filled with change, using a cliff with your vesting schedules helps you award ownership to those who plan to stay with you long-term.

With a cliff, if an employee departs after six months, they don’t obtain the right to any shares. They must complete at least one year of employment (and go over the cliff) before their options begin to vest.

After the year cliff is completed, options are vested on a set schedule, expressed as a percentage or fraction of the total amount. For example:

In this case, an employee obtains the right to an additional 1/48th of their awarded shares on a monthly basis (totalling 25% per year).

If this employee were to leave the organisation prior to the completion of their third year, the vesting frequency was set to yearly, they would potentially have the right to exercise the vested amount of their options.

If the scheme were exit-only, they would not gain this right. In our survey of Vestd customers, we found that 70% applied a minimum of a one-year cliff to their vesting schedule.

Now you have a better understanding of vesting schedules and variables to consider for your EMI scheme. You can check whether your company qualifies for EMI in just two minutes.

We also recommend reading our EMI guide. It’s free and will help you understand how to start rewarding your team with equity.

Then, when you're ready, go ahead and book a free consultation with one of our equity specialists. And see how easy it is to design vesting schedules, issue options and much, much more.

Last updated: 16 April 2024 If you’re planning to start an EMI share options scheme for your business, one of the first decisions you’ll need to make...

Last updated: 27 June 2024. There are many ways to increase employee engagement and look to reward your employees for their hard work. For sure, you...

So, you’ve discovered the Enterprise Management Incentive (EMI), the most tax-efficient employee share option scheme in the UK. Nice! By default, EMI...