Shareholder dashboards

Recipients can track the value of their equity and model future scenarios, to figure out what their pot could be worth.

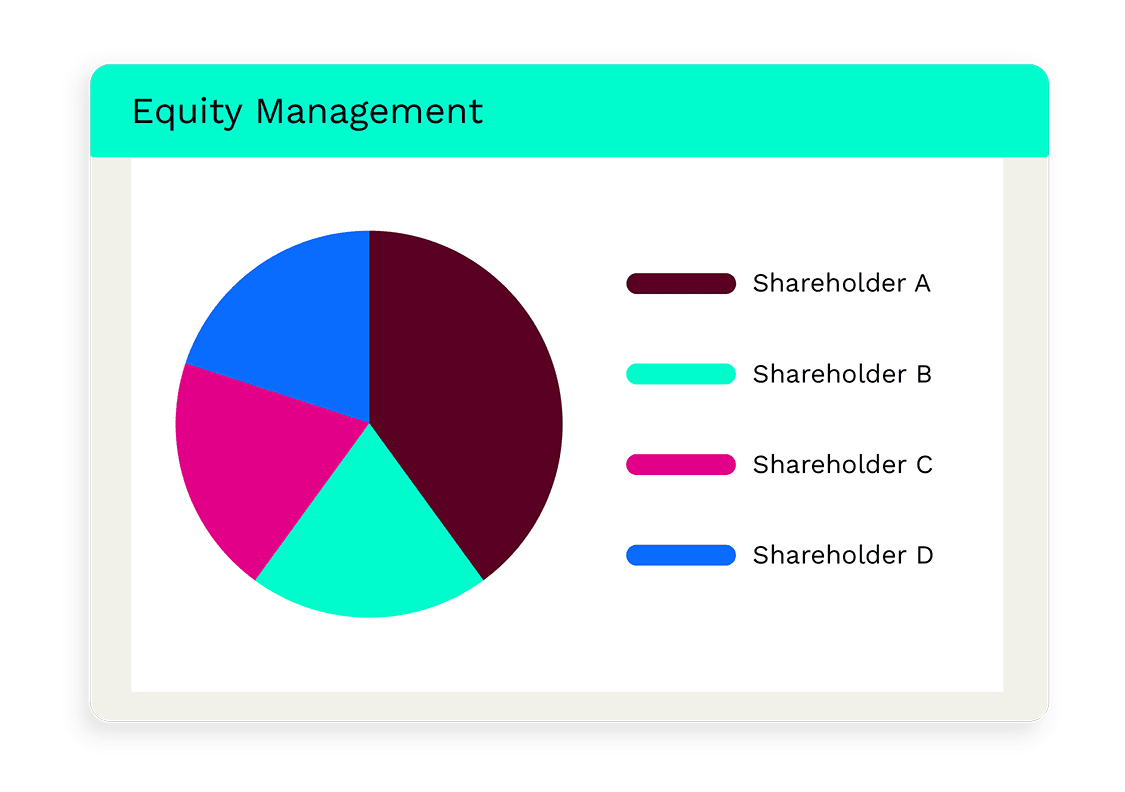

Manage your equity and shareholders

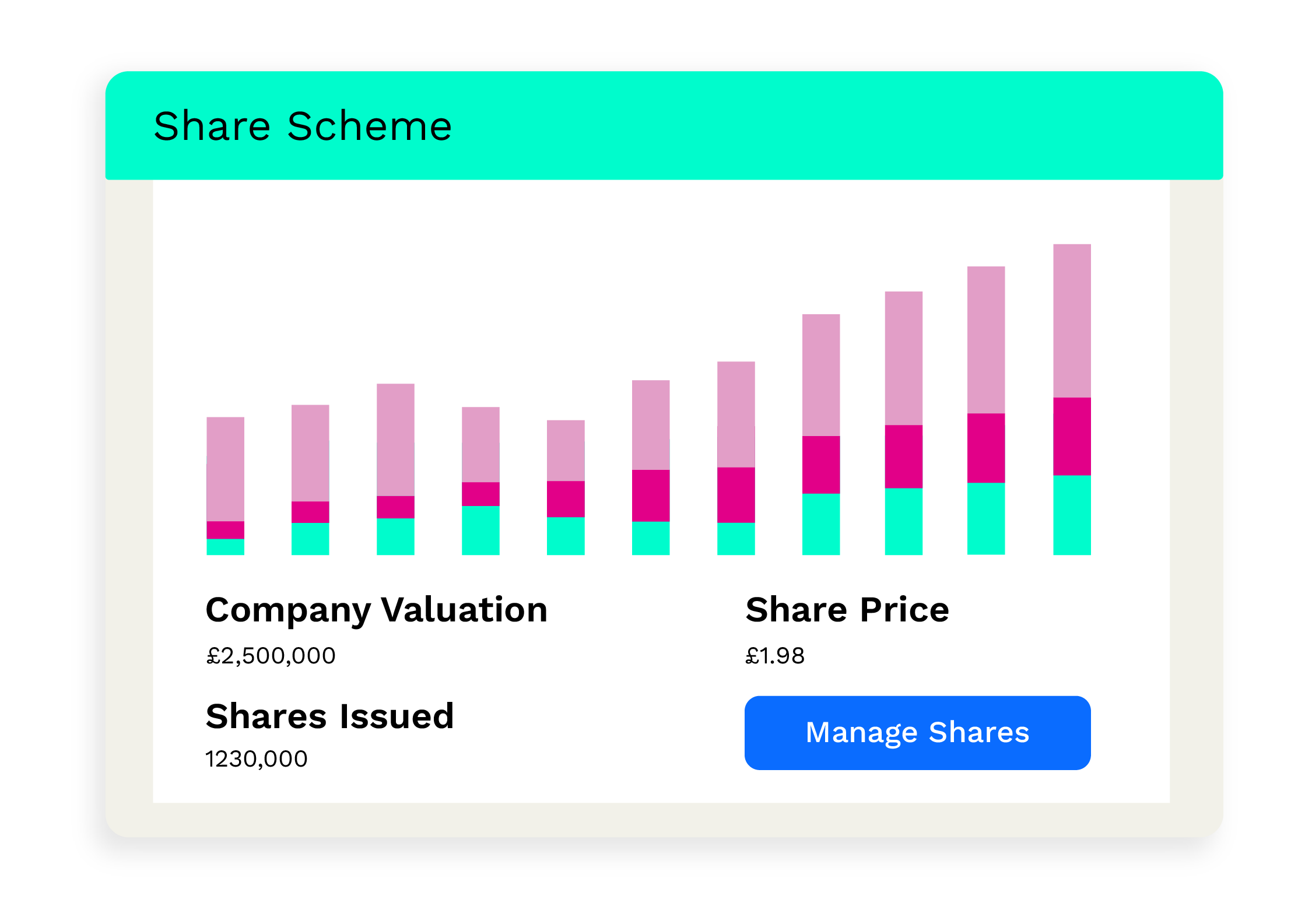

Share schemes & options

Equity management

Migrate to Vestd

Company valuations

Fundraising

Launch funds, evalute deals & invest

Special Purpose Vehicles (SPV)

Manage your portfolio

Model future scenarios

Powerful tools and five-star support

Employee share schemes

Predictable pricing and no hidden charges

For startups

For scaleups & SMEs

For larger companies

Ideas, insight and tools to help you grow

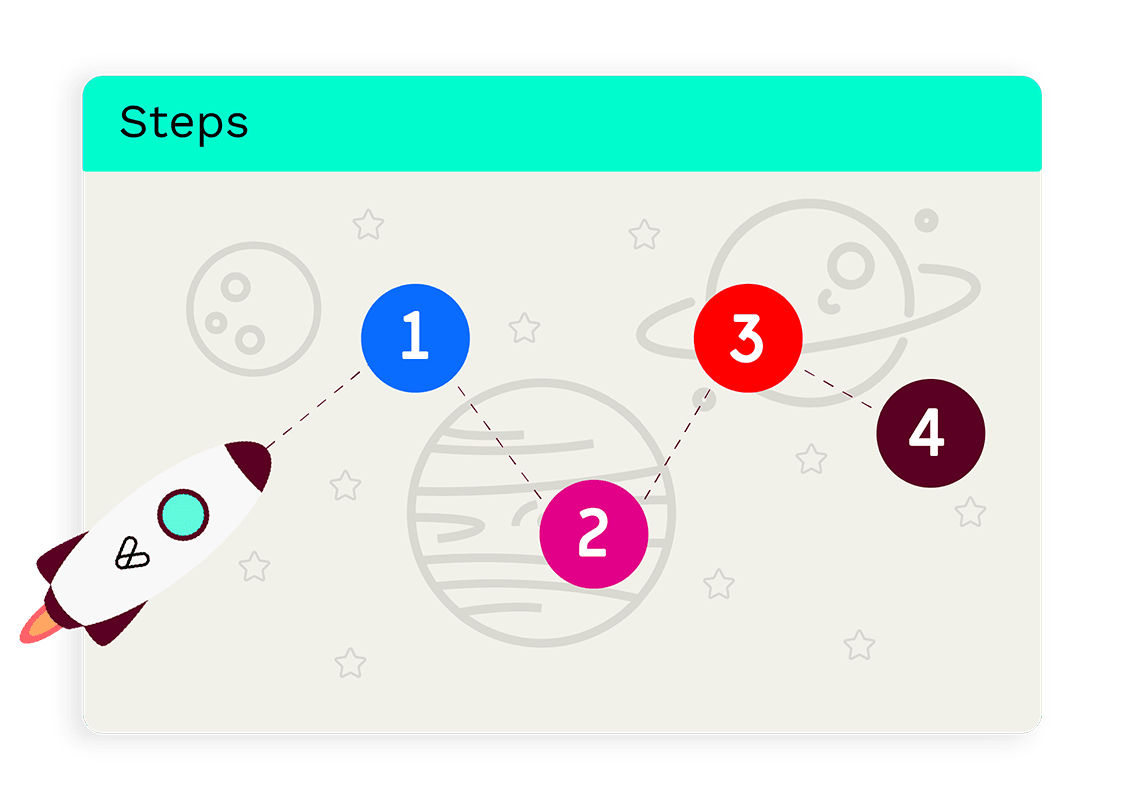

START THE RIGHT WAY

Set up a new company using our guided flow with step-by-step instructions to ensure you get it right first time.

EQUITY REWARDS BASED ON DELIVERY

Design customisable equity agreements and vesting schedules to reward people for what they do, not what they say.

COMPANY ADMIN MADE SIMPLE

Get to grips with your cap table, issue shares, file confirmation statements and much, much more via our two-way integration with Companies House. Everything is done digitally via the platform.

GET THE TEMPLATES YOU NEED

Access a trove of business templates from NDAs to IP agreements to ensure your startup is bulletproof.

Recipients can track the value of their equity and model future scenarios, to figure out what their pot could be worth.

Other providers don't seem to think this matters, but we do. Your equity is your most valuable asset, after all.

You’ll pay a fraction of what accountants and lawyers typically charge to set up share schemes and manage your equity.

The platform itself allows you to manage all aspects of share and option management concisely in one place. The automations and integrations save you time. But while the platform is great, it is the team that makes Vestd stand out. From pre-sales to onboarding and the ever-helpful support team - not only do they support on the platform but provide excellent knowledge in this area.

Great platform. The team always provide brilliant support. I would definitely recommend using Vestd to anyone who needs to set up and administer an EMI scheme.

Straight forward and structured approach - so good for founders and also FD/CFO/advisor who is looking to get share capital and share option schemes in place.

A fantastic platform. The price is fixed. The customer support is fantastic and readily available. They have held our hand right through the whole process.

I love Vestd and I wish I had found it sooner. It makes the whole process of issuing shares whether they're growth shares or ordinary shares incredibly simple.

Amazing shift from Excel to Vestd. The support team were amazing and did a great job of completing our setup and we have been very pleased at being able to better manage our governance over time.

If you're looking to incorporate via Vestd and / or want or design conditional equity agreements for your co-founders then start by booking a discovery call. We will give you a free consultation to guide you through the process.

Every limited company in the UK is split into a certain number of shares, the most common of which are ordinary shares. At their simplest, these give the holders the same rights to dividends, capital and voting in the company.

Many companies are founded with and issue only ordinary shares. However, these are very difficult to claw back. Conditional shares are issued with strings attached. If the recipient does not meet the required KPIs then the shares are simply deferred and cancelled.

Under the Companies Act 2006 all private limited companies are required to report certain information to Companies House including changes to their company structure or business information. This can be done digitally via the Vestd platform.

This happens when a company issues new shares thereby reducing the ownership percentage of existing ones. But, it shouldn’t be as scary as it sounds. If the shares are issued in return for investment or to enfranchise team members, it may well result in the value of the company increasing.