The EMI scheme: Enterprise Management Incentives explained

EMI: the most tax-efficient share scheme

The Enterprise Management Incentive (EMI) scheme is used by more than 14,000 UK companies to motivate and reward employees with incredibly tax-friendly share options. You can easily set up and manage EMI schemes on Vestd.

Free EMI scheme consultation

Ask us anything about shares and learn how to give people skin in the game.

Written by Rachel Krish

Rachel Krish is an Equity Consultant at Vestd.

Page last updated: 22 November 2024

On this page, you'll find all the information you need to compare Enterprise Management Incentives with other share schemes, start an EMI scheme for your employees, and make the proper notifications to HMRC.

You'll also find links to helpful resources, including our EMI eligibility quiz and calculators.

If you're already convinced that an EMI scheme is right for you then book a free consultation. Our experts will make sure your company is eligible and answer any questions you might have. There's no obligation to use Vestd afterwards (though we hope you will!).

Contents

- What's the Enterprise Management Incentive?

- Why do businesses give EMI options to employees?

- What is the eligibility criteria for EMI?

- What's the difference between EMI, growth shares and unapproved options?

- What are the tax implications of EMIs?

- What are the steps to set up an EMI scheme?

- How do I manage an EMI option scheme?

- EMI schemes on Vestd

- Further reading and resources

What is an EMI Scheme?

An Enterprise Management Incentive (EMI) scheme, is a government-backed, tax-advantageous share options scheme.

It's mainly used by small to mid-sized UK businesses looking to share their successes with their team as their company grows.

How do Enterprise Management Incentives work?

In short, by giving employees the opportunity to have skin in the game in the most tax-efficient way possible.

EMIs not only reward your employees with equity in a way that is hugely tax efficient but also allow you to offset both the cost of the scheme and the tax benefits achieved by your employees against your company’s tax liability.

EMI option schemes are relatively flexible, in terms of both the conditionality and the time frames that can be set as part of their terms. You also have the ability to set conditions for recipients, including performance or length-of-service milestones.

If you’re thinking about sharing ownership with your employees, make EMI your first port of call. If you're eligible, there's no better share scheme to set up.

Startup Lead, Guy Kaufman, explains:

Why do businesses give Enterprise Management Incentives to employees?

EMI option schemes allow businesses to:

- Attract and retain the best people over longer periods of time.

- Align interests by giving employees a sense of ownership in your company.

- Reward those who help you grow the business by enabling them to share in its success.

- Benefit from a more committed and engaged workforce: businesses with share schemes tend to outperform businesses that don't share ownership with employees.

Additionally, the tax benefits of an EMI option scheme are more beneficial to employees than the alternatives, which you can read about below.

How does a business qualify for an EMI scheme?

A business must meet certain requirements to qualify for Enterprise Management Incentives. In summary, a business will usually qualify for an EMI scheme if it meets the following:

- Has up to 249 employees.

- Has assets of less than £30m.

- Is not majority owned or controlled by another company.

- Is not in one of the excluded industries, including banking, farming, property development, provision of legal services, shipbuilding, or leasing.

There are also eligibility requirements for individual employees:

- They must spend at least 25 hours per week or 75% of their total working time as a company employee.

- They may not hold more than 30% of the company's shares.

- They may not hold options worth more than £250,000 (at the time of grant).

Check out our full list of EMI qualifications for businesses, employees, and options or take our quick quiz and find out!

QUIZ TIME

Check your EMI scheme eligibility

Take our two-minute quiz today to see if your company could set up an EMI scheme.

Find outWhat's the difference between EMI, growth shares, and unapproved options?

Compared to other share option schemes available to UK-based businesses, EMIs are the most tax-efficient option for both businesses and employees.

Tax is incurred only on the value of the shares at the time of their award rather than at the time of exercise (at which their value may have risen).

Additionally, Capital Gains Tax (CGT) is applied at a lower rate versus the standard rate (so long as the shares are not sold within 24 months of the option grant).

That's because EMI options are eligible for Business Asset Disposal Relief (BADR) so long as a few conditions are met. At present, the rate is 14% and will remain that way for the rest of the current tax year. In the 2026/27 tax year, it will rise to 18%.

Standard Capital Gains Tax is now charged at 18% for basic rate taxpayers, or 24% for higher or additional rate taxpayers.

The chart below outlines the main differences between EMI options, CSOP options, growth shares, unapproved options and ordinary shares. (Click to enlarge).

Due to its requirements and tax advantages, an EMI share scheme is most attractive to UK-based SMEs seeking to share their success with a small to medium-sized team (under 250 employees).

What are the tax implications of Enterprise Management Incentives for my company?

Businesses offering EMIs are eligible for a corporation tax (CT) relief if qualifying shares are acquired by employees upon the exercise of an EMI option.

The CT relief is typically the difference between what the employee pays for their shares and their value when their options are exercised.

What about my team?

Employees receiving option grants via an EMI scheme are eligible for Business Asset Disposal Relief (BADR), formerly known as Entrepreneurs' Relief, at the time of sale.

This tax relief allows for a discounted rate (versus the standard rate) on any gains on the actual market value (AMV) of shares at the time of grant, so long as the shares are sold at least 24 months from the date of the option grant.

Disqualifying events

If there is a disqualifying event that causes your business, an employee, or the options scheme to no longer meet the qualifying criteria, the options will lose their advantaged tax status unless they are exercised within 90 days of the event.

For more details on the tax implications of EMIs, we suggest reading one of the pages linked above, this summary or seeking advice from your tax professional.

What happens to an employee's EMI options if they leave?

An employee leaving the company is classed as a disqualifying event. So employees must exercise their EMI options within 90 days, otherwise, any gains will be subject to Income Tax and possibly National Insurance.

Watertight EMI option agreements include leaver clauses, which outline what will happen to an employee's options depending on the circumstances surrounding their departure.

If an employee has truly earned their slice of the pie, we see no reason why they shouldn't get to share in the value they helped to create. That's where the notion of 'good leavers' and 'bad leavers' comes in.

What does the EMI scheme setup process look like?

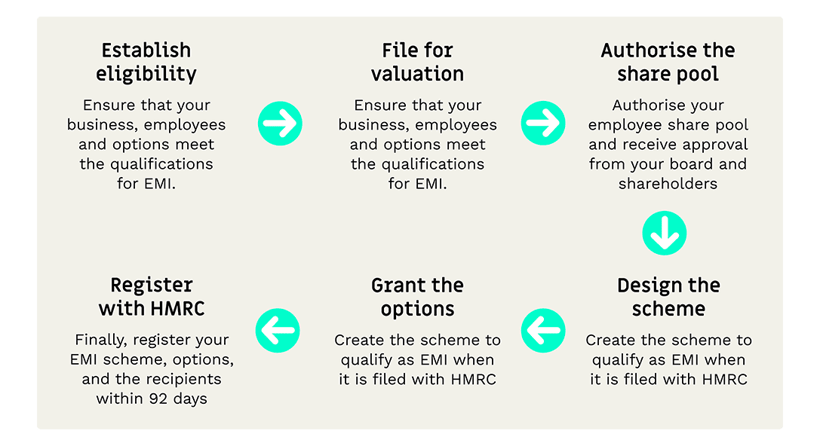

Once you have established your eligibility for Enterprise Management Incentives, the owner must file with HMRC to receive a valuation for approval. It's valid for 90 days and provides some certainty regarding tax treatment going forward, as long as all due criteria and processes are followed.

Once the valuation is agreed upon, you will need to authorise your employee share pool and receive approval from your board and any shareholders. After this, you can design your scheme and grant options to employees.

Finally, your business must register its EMI scheme, options, and recipients with HMRC within 92 days of its first option grant.

This process can be challenging for business owners, who have many other things to focus on. And this is precisely why we built Vestd.

The platform - and our team of EMI experts - can assist with the setup of your EMI scheme, help you generate a valuation and file it with HMRC, create dynamic vesting schedules, and make the long-term management of your issued options easier.

By using our share scheme platform, you'll avoid hassles and unnecessary costs and ensure that your business stays compliant through to exit.

How do I manage an EMI option scheme?

Long term, you will need to manage your Enterprise Management Incentive scheme by adding new recipients, removing recipients, and updating your cap table to reflect the current options issued.

You will also need to notify HMRC of any changes, such as new option grants, employee departures, or a company exit (buyout or change in ownership).

Managing your EMI scheme on your own can be very difficult and time-consuming. And the cost of getting it wrong is dear.

By using Vestd, you will have access to features that help you manage your scheme without any hassle.

Let's discuss tax-efficient shares & options!

Thinking about giving your team some skin in the game?

We'll help you understand how to design a share scheme in next to no time. Calls are totally free and there's no obligation to use Vestd afterwards.

Further reading and resources

We have a ton of guides to help UK startups, SMEs, and their teams fully understand EMI. Check out the links below:

Further reading

- Full EMI eligibility details

- EMI eligibility quiz

- How HMRC EMI valuations work

- How to grant EMI options to employees

- How to select a vesting schedule for your EMI scheme

- How to exercise EMI options

- EMI tax benefits explained

- EMI blogs

Resources

Calculators

- EMI vs Growth Shares calculator

- EMI vs Unapproved Options calculator

- EMI vs Growth Shares vs Unapproved Options calculator

- Calculate how many shares to allocate to your EMI option pool