ASA vs CLN: Key Differences for Startups | Vestd

When looking to raise investment, choosing the right legal structure is vital when considering your long-term plan.

Manage your equity and shareholders

Share schemes & options

Equity management

Migrate to Vestd

Company valuations

Fundraising

Launch funds, evalute deals & invest

Special Purpose Vehicles (SPV)

Manage your portfolio

Model future scenarios

Powerful tools and five-star support

Employee share schemes

Predictable pricing and no hidden charges

For startups

For scaleups & SMEs

For larger companies

Ideas, insight and tools to help you grow

3 min read

Chris Nash

:

Updated on November 24, 2025

Chris Nash

:

Updated on November 24, 2025

Table of Contents

Fundraising doesn’t always have to be a large all-in-one marathon. Whilst it’s easy to craft a vision of grandiose raises to fuel accelerated growth, many founders are choosing to raise through smaller, faster, and more flexible ‘micro rounds’.

These are quick funding injections designed to extend runway, test traction, or bridge the gap between bigger milestones. Whether it’s a top-up round, a bridge to a larger raise, or a syndicate-led SPV, these micro rounds have become a vital part of the modern fundraising landscape.

Let’s break down what they are, how to structure them, and why they might be right for your startup.

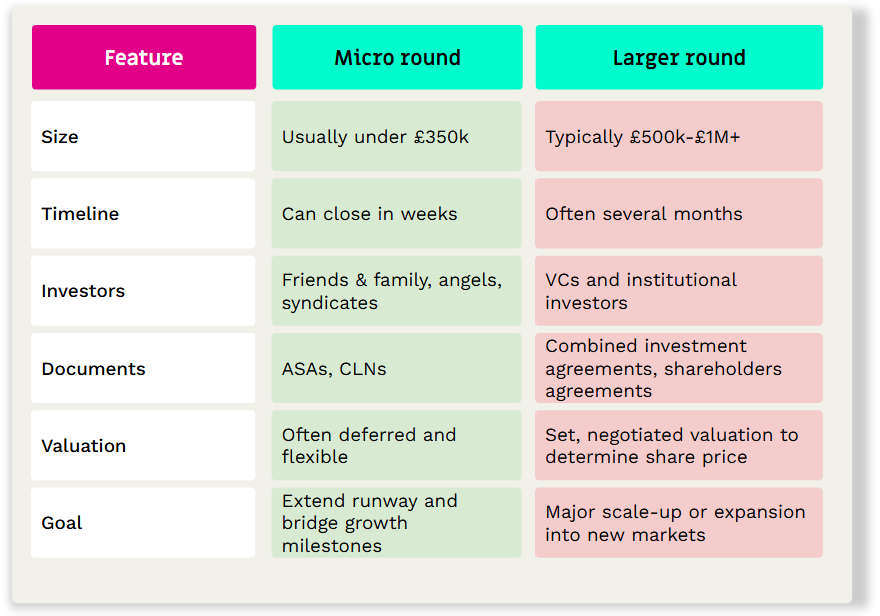

A micro round is a smaller-scale fundraising event, typically £350k or under, that allows founders to bring in capital from a range of investors without committing to a full seed round.

They come in a few common forms:

These rounds are often faster to close, less admin heavy, and more flexible in valuation or structure than traditional rounds.

Because of their size and purpose, micro rounds tend to prioritise speed, efficiency, and simplicity, giving founders the room to progress and grow without locking in lengthy negotiations.

Whilst there is no one-size-fits-all approach, the structure you choose will depend on the type of investors you have, the timing, and the way you want it to look on your cap table.

One of the most effective (and increasingly popular) ways to structure a micro round is through an SPV.

An SPV is a separate legal entity created solely to hold investments from multiple backers. Instead of having 10 or 20 angel investors appear individually on your cap table, those investors each contribute to the SPV, which then invests in your company as a single entity.

This structure is especially useful when you’re raising smaller amounts from a network of individuals.

Why founders use SPVs:

Micro rounds aren’t there to replace larger rounds entirely, but they should complement them to aid growth and facilitate you reaching key goals.

They’re especially useful between milestones: post-seed but pre-Series A, or between larger institutional rounds. They help founders keep momentum while aligning the timing of key cash injection with actual business needs.

Larger funding rounds still play an important role in the growth journey for many startups. Whether you’re scaling operations, entering new markets, or hiring a full team, the greater capital requirements will exceed what a micro round can provide.

Larger rounds also might attract bigger institutional investors who bring not only deeper pockets but also strategic support, credibility, and crucial access to broader networks.

In most cases, micro rounds act as stepping stones that help founders to build momentum, validate traction, and strengthen their position ahead of those bigger, transformational raises.

With InVestd, you can structure, manage, and complete as many funding rounds as you like for one fixed subscription fee. That means unlimited SEIS/EIS filings, unlimited investor documents, and unlimited rounds - without worrying about hidden costs or one-off fees.

So if you’ve launched a seed round, but need a top-up or bridge round to see key milestones get over the line, you won’t need to work about digging deeper to raise again.

So whether you’re raising £50k from an angel syndicate or £5m from VCs, you can focus on what matters: growing your business..

When looking to raise investment, choosing the right legal structure is vital when considering your long-term plan.

Everyone starts somewhere. And for many startups, that first injection of capital comes from people who already believe in you – your friends and...

Starting a business is an exciting prospect. But it is not as simple as having a great idea, and hitting the ‘incorporate’ button—there are a few...