How UK companies can give US employees stock options

Last updated: 17 June 2024. Stock option schemes (or what we tend to call share option schemes in the UK) are a surefire method of uniting teams...

Manage your equity and shareholders

Share schemes & options

Equity management

Migrate to Vestd

Company valuations

Fundraising

Launch funds, evalute deals & invest

Special Purpose Vehicles (SPV)

Manage your portfolio

Model future scenarios

Powerful tools and five-star support

Employee share schemes

Predictable pricing and no hidden charges

For startups

For scaleups & SMEs

For larger companies

Ideas, insight and tools to help you grow

This article is more than 7 years old. Some information may no longer be current.

You might talk about giving your team share options… But what does that mean, and what are the different types?

If the team member is an employee then it is likely that HMRC-approved EMI options will work out best all round (for you and the employee).

But if they are not an employee, then ordinary or unapproved options may be considered (or growth shares, but that’s another story). So what does that really mean for the team members?

That’s why we’ve created the EMI options vs unapproved share options calculator, so you can quickly and simply compare the net outcome under each scenario.

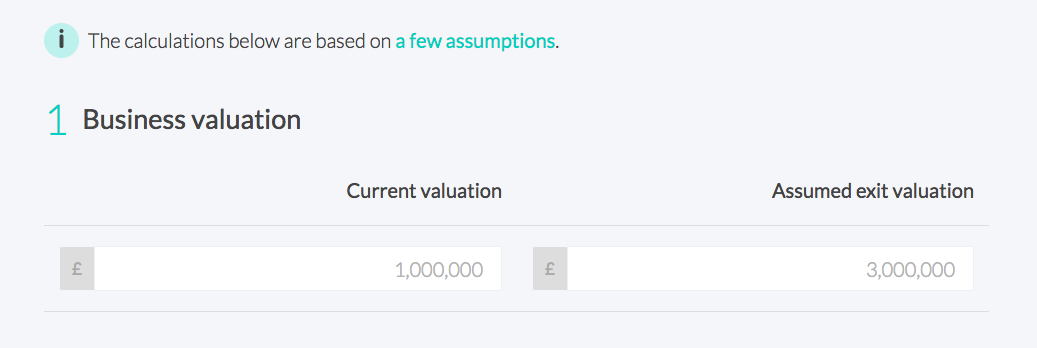

You start with an estimate of the business value today and assume a future exit valuation (you are allowed to dream at this stage, but more helpful to be objective).

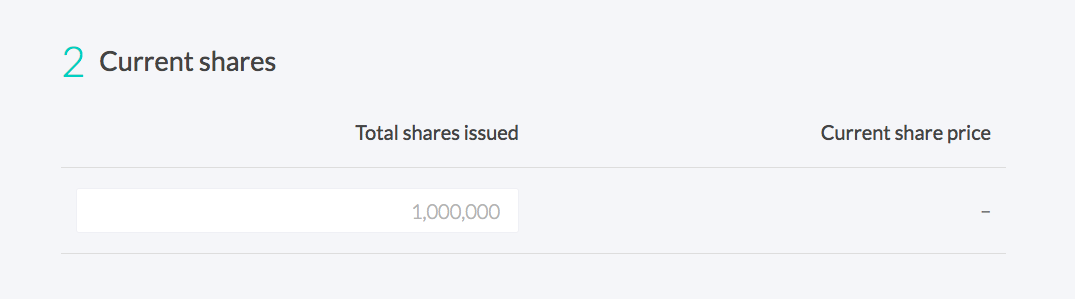

Enter the total number of shares you’ve issued, and your hope premium. The calculator will then quickly work out your current share price.

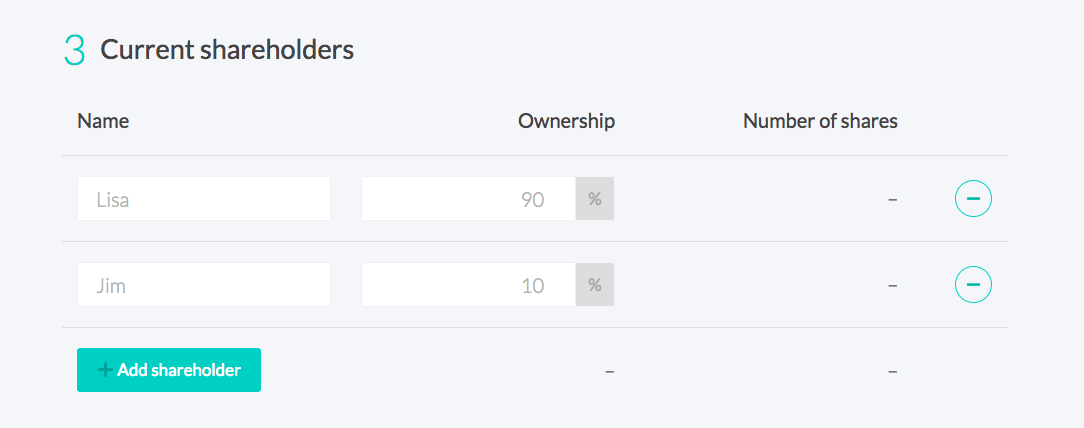

Just pop in their name and percentage of ownership. The calculator will tell you what that means in terms of number of shares.

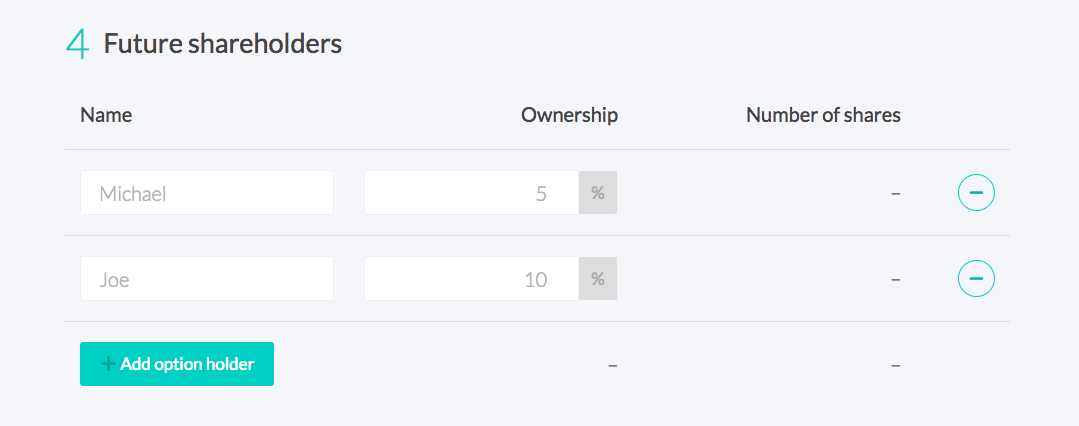

Same details as existing shareholders but for your lucky new ones.

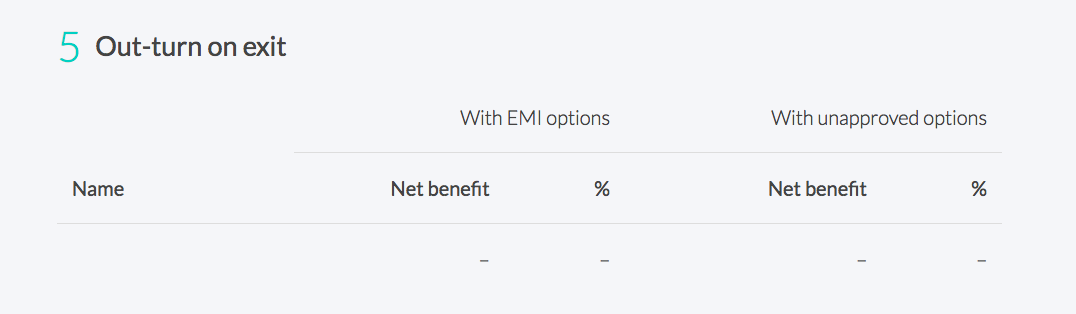

This is the magic bit. From the information you’ve added the calculator has worked out the net benefit for each recipient for both EMI and for unapproved share options. So you can easily see which one works out best for your shareholders.

If you want to learn a bit more about the different options first, I’ve laid out some more information.

Her Majesty’s Government have also recognised the power of shared ownership and put together the Enterprise Management Incentive (EMI) scheme. The scheme not only allows you to reward your employees with share options with massive tax advantages, but also allows you to offset the cost against any exit proceeds.

If you’re sharing ownership with your employees, an EMI scheme makes a lot of sense.

Unapproved options are pretty simple. They are also flexible and can be given to employees, contractors, advisors, consultants, you get the picture.

Another factor adding to the simplicity is that unapproved options don’t require any formal valuation or notification to HMRC when the options are set up (unlike EMI), although they do need to be included in an annual report to HMRC via ERS if they have been given to employees or directors.

The big disadvantage with unapproved options is that there is no tax benefit for the recipient.

The recipient is liable for income tax on the difference between the exercise price and the market value of the shares at the time. An employee may also be liable to pay national insurance on this, if the shares are readily convertible to cash at the point of exercise (eg in a sale scenario).

Last updated: 17 June 2024. Stock option schemes (or what we tend to call share option schemes in the UK) are a surefire method of uniting teams...

Last updated: 17 April 2024 Among the best ways to share ownership with your team in the UK is through a share option scheme. Options are essentially...

Fast-forward five years. You can finally exercise (purchase) your share options. Except there’s a problem - you don’t have the cash.