How to get SEIS funding for your startup

Last updated: 22 January 2025. Are you looking for a cash injection for your startup? The Seed Enterprise Investment Scheme (SEIS) could be for you.

Manage your equity and shareholders

Share schemes & options

Equity management

Migrate to Vestd

Company valuations

Fundraising

Launch funds, evalute deals & invest

Special Purpose Vehicles (SPV)

Manage your portfolio

Model future scenarios

Powerful tools and five-star support

Employee share schemes

Predictable pricing and no hidden charges

For startups

For scaleups & SMEs

For larger companies

Ideas, insight and tools to help you grow

2 min read

Chris Nash

:

Updated on December 10, 2025

Chris Nash

:

Updated on December 10, 2025

You’ve probably seen the headlines around the government’s new Budget 2025 announcement, with changes to EMI dominating the founder space. However, there have also been other changes to EIS and VCT that, if you’re building a high-growth business, are worth paying attention to.

Most of the major changes come into effect in April 2026, but the direction is clear - they want to make funding for high-growth businesses more accessible, flexible, and attractive to investors.

If you’re planning to raise under EIS or VCT in the next couple of years, this is likely to have a real impact on your strategy - let’s break it down.

One of the most significant updates is the decision to double the limits for EIS and VCT. This is a major move, particularly for startups scaling fast and worried about the transition into scale-up territory.

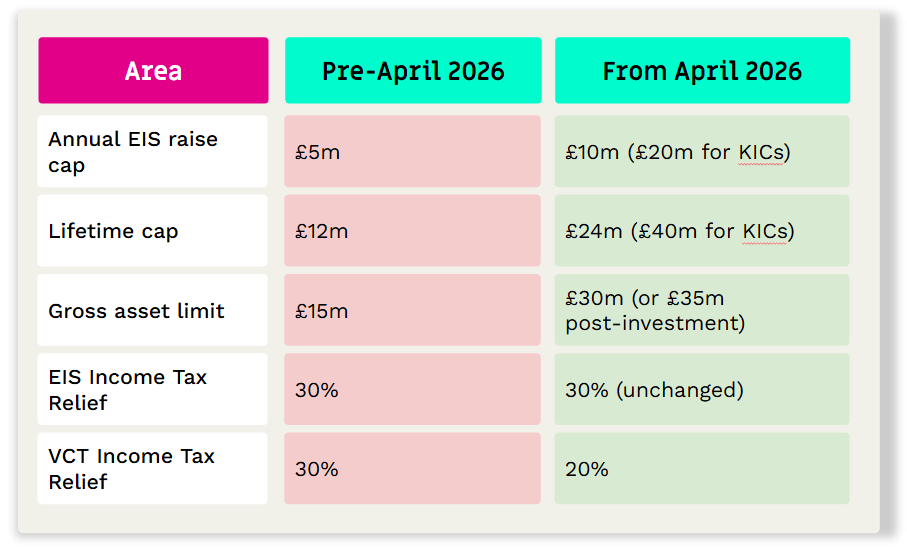

From April 2026, the annual EIS raise cap will increase from £ 5m to £10m, with Knowledge Intensive Companies (KICs) able to raise up to £20m annually.

At the same time, the lifetime investment limit for companies jumps from £12m to £24m (or £40m for KICs). Even the gross asset threshold is getting a sizeable bump to £30m pre-investment, or £35m post-investment.

These are meaningful changes. They don’t re-write the mechanics of EIS - the key tax relief still sits at 30% - but they do expand the runway for companies who were worried about maxing out of EIS limits and losing that investor incentive. Investors will still receive the same level of EIS relief, which should help maintain strong demand.

The one notable decrease is on the VCT side, where relief drops slightly from 30% to 20%. Whilst this is still attractive, it’s less than before.

For fast-growing businesses, these adjustments solve a long-standing challenge: outgrowing EIS before you’ve had the chance to properly scale.

With the increased limits, companies now have:

More room to grow before ageing out: You can raise larger rounds while still benefiting from EIS eligibility, which can be a huge incentive for investors.

A clearer path towards follow-on funding: The new thresholds make multi-stage raises more realistic without having to switch strategy, lose momentum, or find new investor pools.

Increased investor appetite: EIS remains one of the most founder-friendly fundraising incentives around the world. Doubling the limits sends a strong message that the UK wants to keep that competitive edge.

Ultimately, this is a sign of confidence from the government: high-growth companies are a priority, and the goal is to keep them scaling here rather than drifting to more flexible markets overseas.

This should mean founders are encouraged to grow, raise investment, and take advantage of these government incentives for longer.

Beyond EIS and VCT, there aren’t too many other changes in the investments space, which will come as a relief to many founders!

While these updates may not be headline-grabbing, stability is valuable, suggesting a period of relative consistency for founders planning ahead.

If you want to make the most of the increased allowances (and you haven't already), it’s worth getting your EIS advance assurance in place early. With InVestd Raise, you can:

...and much more!

Book a call to learn more about how InVestd can help you prepare for investment the smart way.

Last updated: 22 January 2025. Are you looking for a cash injection for your startup? The Seed Enterprise Investment Scheme (SEIS) could be for you.

You’ve done your research.

Starting a business is an exciting prospect. But it is not as simple as having a great idea, and hitting the ‘incorporate’ button—there are a few...