Why it's better to set up a share scheme sooner rather than later

Last updated: 17 April 2024 Share schemes equip businesses with a means to incentivise employees beyond capital alone.

Manage your equity and shareholders

Share schemes & options

Equity management

Migrate to Vestd

Company valuations

Fundraising

Launch funds, evalute deals & invest

Special Purpose Vehicles (SPV)

Manage your portfolio

Model future scenarios

Powerful tools and five-star support

Employee share schemes

Predictable pricing and no hidden charges

For startups

For scaleups & SMEs

For larger companies

Ideas, insight and tools to help you grow

4 min read

Naveed Akram

:

Updated on September 8, 2025

Naveed Akram

:

Updated on September 8, 2025

This blog is more than 7 years old. Some information, including tax rates, may no longer be correct.

You love your team and want to share ownership of your business with them. But you’re exhausted trying to navigate all the tax and the law governing equity distribution. Does this sound like you?

I meet so many business owners at the point of decision fatigue when it comes to giving shares in their business. Comments like below are common:

Take a look at our Complete Guide to Setting Up a Company Share Scheme to see how to avoid some of these problems.

80% of the pain in my experience is linked to three areas:

Tax

Types of shares to give (real vs options)

What if someone leaves or doesn’t deliver

I’m not an accountant or lawyer (and don’t pretend to play one on the internet) but I do spend most of my days navigating the share and equity landscape with business owners.

In this post I’ll try to demystify each of these areas and provide some much needed clarification. Think of these as basic truths rather than advice in any way.

If you can get your head around these, you’ll relieve yourself of the majority of confusion and anxiety most business owners feel.

Points 1 (tax) and 2 (type of share to give) are intrinsically linked so lets start with some tax basics here and then we’ll finish off, in context of the various types of shares, in the next point.

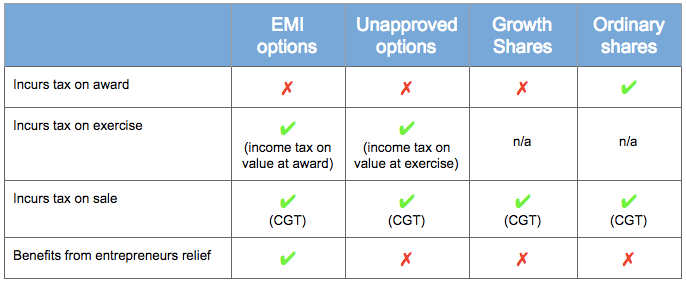

In the UK, there are three points at which tax can be due:

On award (only effects ordinary shares)

On exercise (only effects options)

On sale (always due on all shares)

Then there are two different types of tax that generally apply:

CGT (capital gains tax) — typically between 10–20% and is due on sale of the shares and applied to the gain in value of your shares from the point they were given. Or in the case of options, on any gain in value over the price paid on exercise.

Income tax — typically between 20–45% (based on the recipients current tax rate) and is due at the point that the option is exercised, or in some cases, on sale.

Essentially it breaks down like this:

Tax by share type

Tax by share type

A note on Entrepreneurs’ Relief: ER means you’ll pay a maximum of 10% on all gains. In this context only EMI schemes will qualify but founders also benefit from ER as the shares are in their name when the business is incorporated.

Options (issued at a later date at a pre-agreed price).

In the UK, the first question to ask is are the people you are giving shares to employees (i.e. they spend more than 75% of their time at your business) or not?

If yes (and you company meets the qualifying criteria for EMI), the quick answer is that in almost all cases an EMI option scheme will be the most tax efficient way for the business to give and for the employee to receive shares. The government tax wrapper is just that good.

The one issue with options (EMI or unapproved) is that they aren’t real shares until they’ve been exercised so the recipient won’t get any other benefits (such as dividends).

If you are a high growth business aiming for an exit, that likely won’t matter but if you are a business not focused on selling and here for the long term, growth shares (see below) are a great alternative to EMI options and usually the next best from a tax efficiency perspective.

Options summary:

Unapproved options can be granted to anyone

EMI options can only be granted to employees working more than 75% of their time at the business

Not real shares until exercised so don’t get any benefits of being a shareholder (like dividends)

Incur a tax liability on exercise and in some cases a cost to exercise (purchase the shares), which some employees may struggle to afford. They also have a limited exercise window (which may not give recipients enough time to find the cash to purchase)

If the business isn’t gearing up for exit they may incentivise the wrong behaviour and attitude.

Real shares (ordinary or growth shares):

Ordinary shares are real share in the business (rather than an option to buy at a later date) and can be given to anyone. They are typically the shares business owners and investors will hold.

Growth shares are just like ordinary shares (real shares) but are issued at a ‘hurdle price’ that represents the value of the company at that time. So they only share in the capital appreciation (the businesses growth in value) from that point on. This means that the recipient has no tax to pay on receipt of the shares, no exercise price to pay in the future and will only pay CGT on sale (typically between 10-20%).

Growth shares benefit from receiving dividends and the giver can choose to give them with or without voting rights (which is incredibly easy to do on Vestd).

Real shares summary:

Only incur CGT tax

No tax on issue (if growth shares)

Real ownership (and voting rights should you choose). The shares are in their name and they also benefit from dividends.

This is a biggie for business owners and the thing that seems to keep them up at night the most when architecting their share scheme. So let’s just squash most of the misunderstanding around this immediately…

Most shares can be given with some degree of “conditions”. That means, whether it’s a growth share or an EMI option scheme (or an unapproved option for that matter) you can (should you wish) set criteria which must be met for the person to qualify for receiving these shares.

With options, this is a ‘vesting period’ and with ordinary/growth shares, you could have a ‘conditional period’, during which the shares can be deferred to worthless shares.

The criteria would typically consist of:

Number of shares — how many will they get

Time horizon (or vesting/conditional period) — when will they get them

Performance conditions — what they must do before the shares are fully theirs. This might include things like staying with the business for a minimum period. Minimum deliverables you’d expect from the person in that role. Etc.

So, as a business owner you have pretty good protection should an individual leave or not deliver. However, it’s important for the equity to create the desired impact and incentive.

That means the recipient also needs to feel that the criteria is fair. You could think of setting conditions as protecting yourself in the worst case rather than outlining the dream situation. Businesses change and you don’t want criteria so rigid that they don’t allow for that.

Questions about share schemes? Book a free consultation with an equity specialist.

Last updated: 17 April 2024 Share schemes equip businesses with a means to incentivise employees beyond capital alone.

Last updated: 19 April 2024

Setting up a company share scheme is one of the best things you can do to create a successful business.