Reward your team with a UK tax-advantaged share scheme

We help US companies set up, launch and manage fully compliant share schemes designed for UK employees.

Schedule a free equity consultation and we'll show you how our FCA regulated sharetech platform can help you get started.

.png?width=458&height=99&name=Capterra%20G2%20B%20Corp%20Dark%20(1).png)

.png)

Why Vestd?

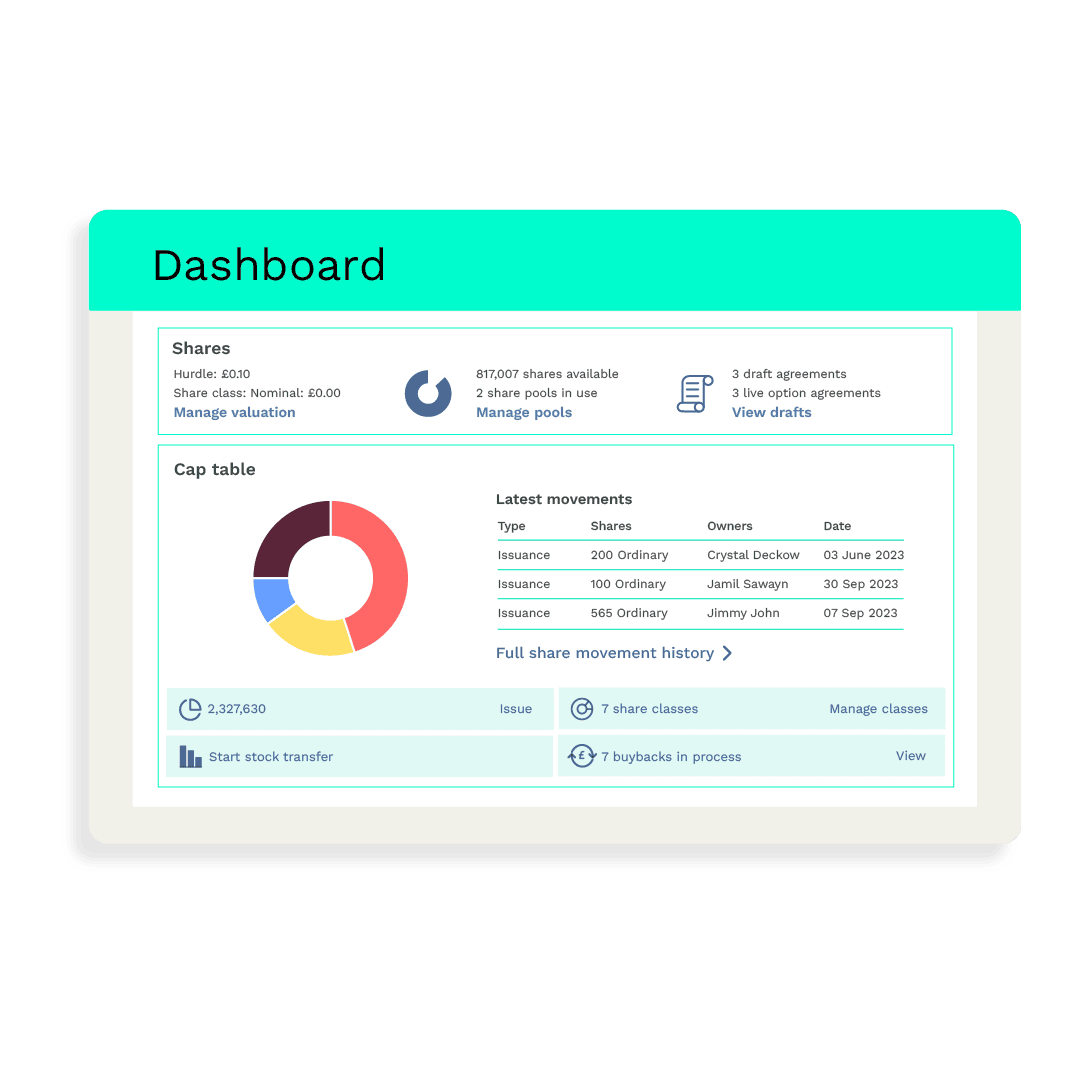

The UK’s equity specialists: Vestd was the first purpose-built platform for share schemes. We have helped thousands of founders set up schemes at a fraction of the cost with two-way Companies House integration and a real-time digital cap table.

Company valuations: You’ll need a specific HMRC valuation for UK schemes (distinct to 409a) and as your company grows. Our team provides up-to-date, defensible valuations, with 409a valuations if needed.

Guided scheme design: Vestd provides UK companies with a fully guided service for share and option schemes, including agreement documentation for EMI, CSOP or Unapproved Options. You’ll always get five star support. Get started by booking a free consultation.

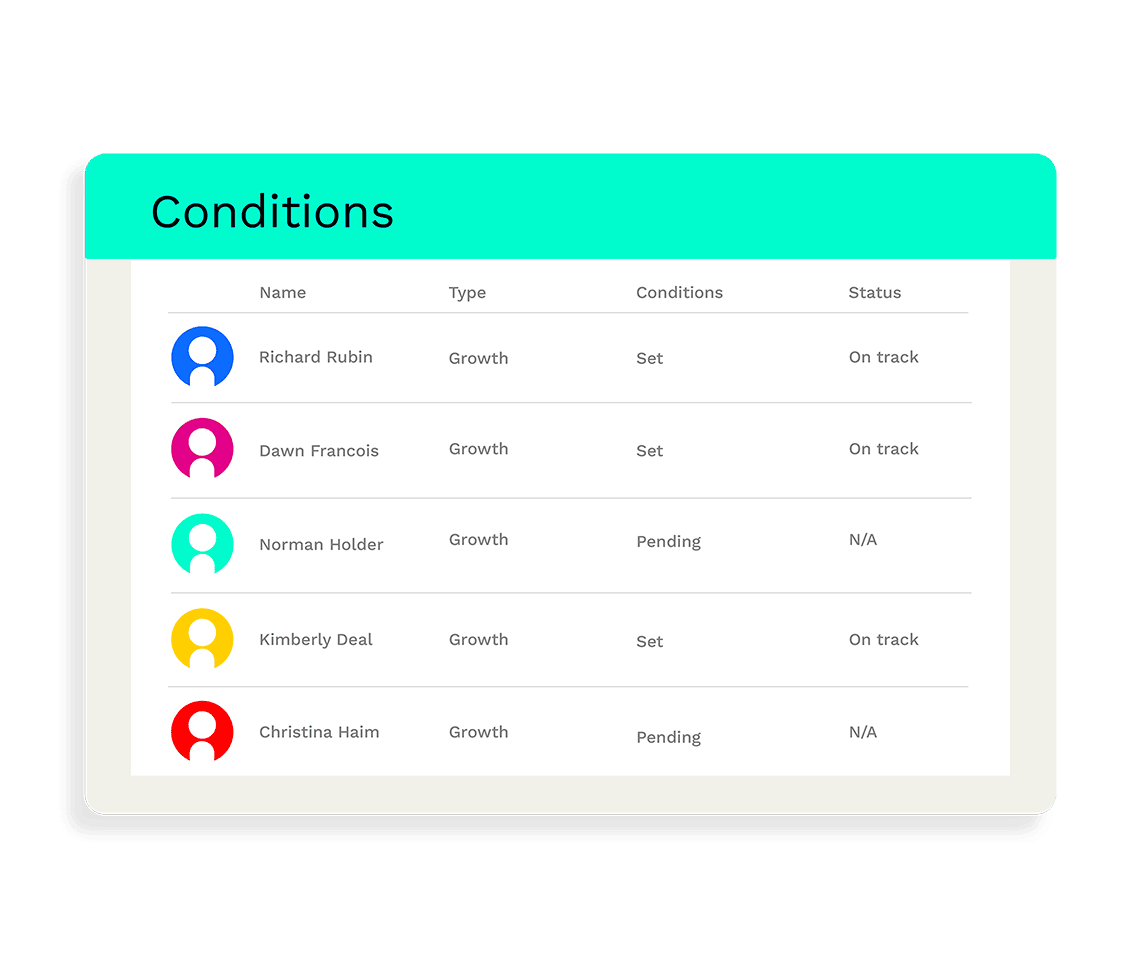

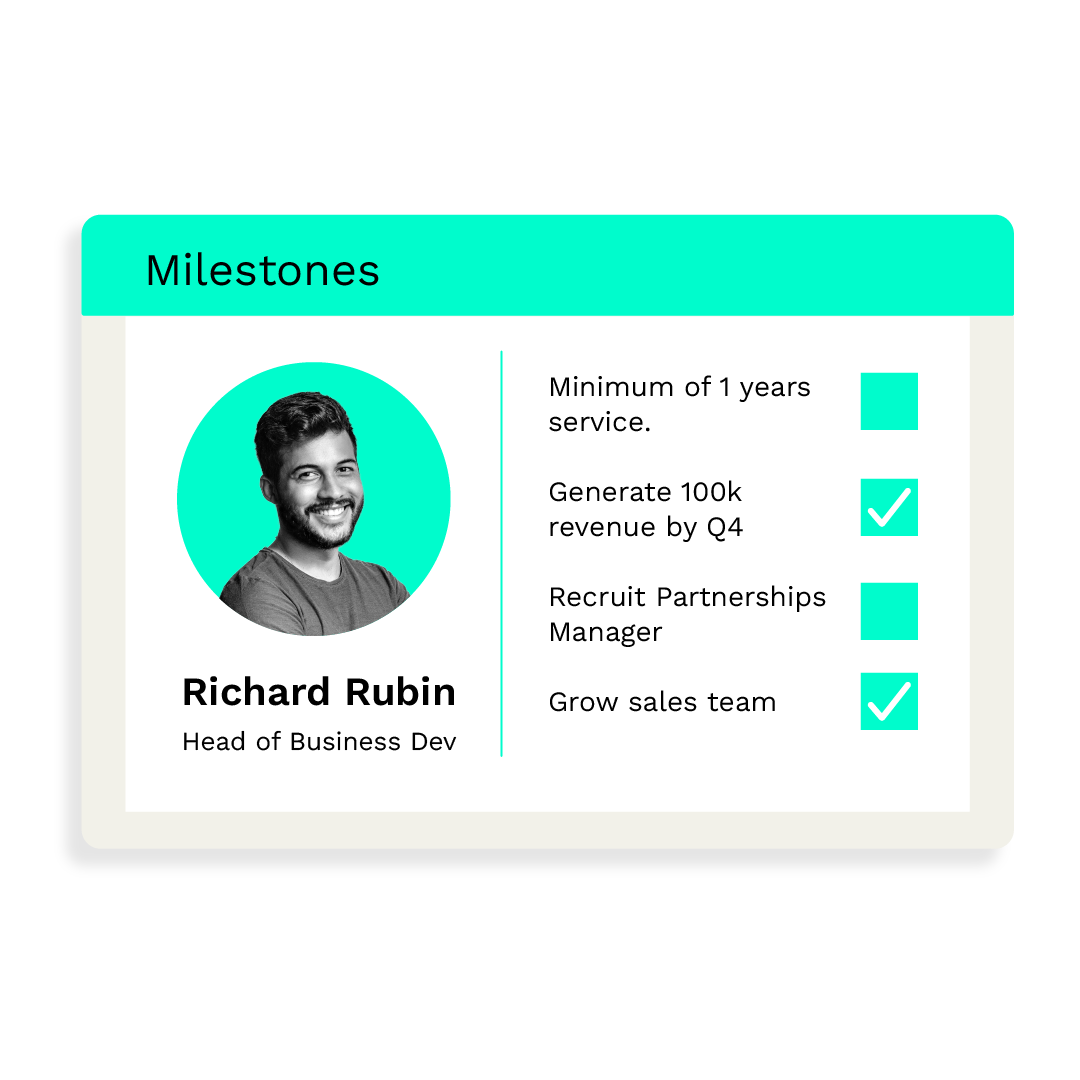

Custom terms and conditions: You can design individual agreements for each team member. We're big on 'conditional equity'.

Digitise existing schemes: If you already have existing schemes, including ISO and NSO in the US, we can help you digitise and bring them onto Vestd.

Authorised and regulated by the FCA, as well as ISO 27001 and B Corp certified: our competitors don't seem to think this matters, but we do.

How to give UK employees stock options

Here’s a step-by-step guide to offering UK employees qualifying stock options.

1. Establish eligibility

Ensure that your business, employees and options meet the qualifications for EMI.

2. File for valuation

Ensure that your business, employees and options meet the qualifications for EMI.

3. Authorise the share pool

Authorise your employee share pool and recieve approval from your board and shareholders.

4. Design the scheme

Create the scheme to qualify as EMI when it is filed with HMRC.

5. Grant the options

Create the scheme to qualify as EMI when it is filed with HMRC.

6. Register with HMRC

Finally, register your EMI scheme, options, and the recipients within days.

Book a free equity consultation

Vestd can help you incorporate your UK company and help you set up your share scheme.