The UK’s equity experts

Vestd was the first purpose-built platform for ESOPs. We have helped thousands of founders to create share and option schemes.

Manage your equity and shareholders

Share schemes & options

Equity management

Migrate to Vestd

Company valuations

Fundraising

Launch funds, evalute deals & invest

Special Purpose Vehicles (SPV)

Manage your portfolio

Model future scenarios

Powerful tools and five-star support

Employee share schemes

Predictable pricing and no hidden charges

For startups

For scaleups & SMEs

For larger companies

Ideas, insight and tools to help you grow

Set up and manage an employee stock option plan (ESOP) on Vestd, the UK’s leading equity platform. Tax-efficient, guided, and fully digital.

Talk to an ESOP expertLearn more

An employee stock option plan (ESOP) gives team members the right to purchase company shares, usually at a fixed price, after meeting certain conditions. In the UK, these plans often take the form of EMI schemes or Unapproved Options, offering flexible structures and potential tax advantages for both employees and employers.

Vestd makes it easy to launch and manage a compliant stock option plan that works for your business goals.

Vestd was the first purpose-built platform for ESOPs. We have helped thousands of founders to create share and option schemes.

Vestd provides UK companies with a fully guided service for share and option schemes. You’ll always get five star support.

Vestd is the UK’s only equity management platform that is fully synced to Companies House with a two-way, read-and-write connection.

.png)

Employee stock option plans (ESOPs) help you attract, retain and motivate top talent. Vestd makes it easy to launch a tax-efficient plan tailored to your company’s needs.

✓ 95% of customers say their scheme has increased employee retention

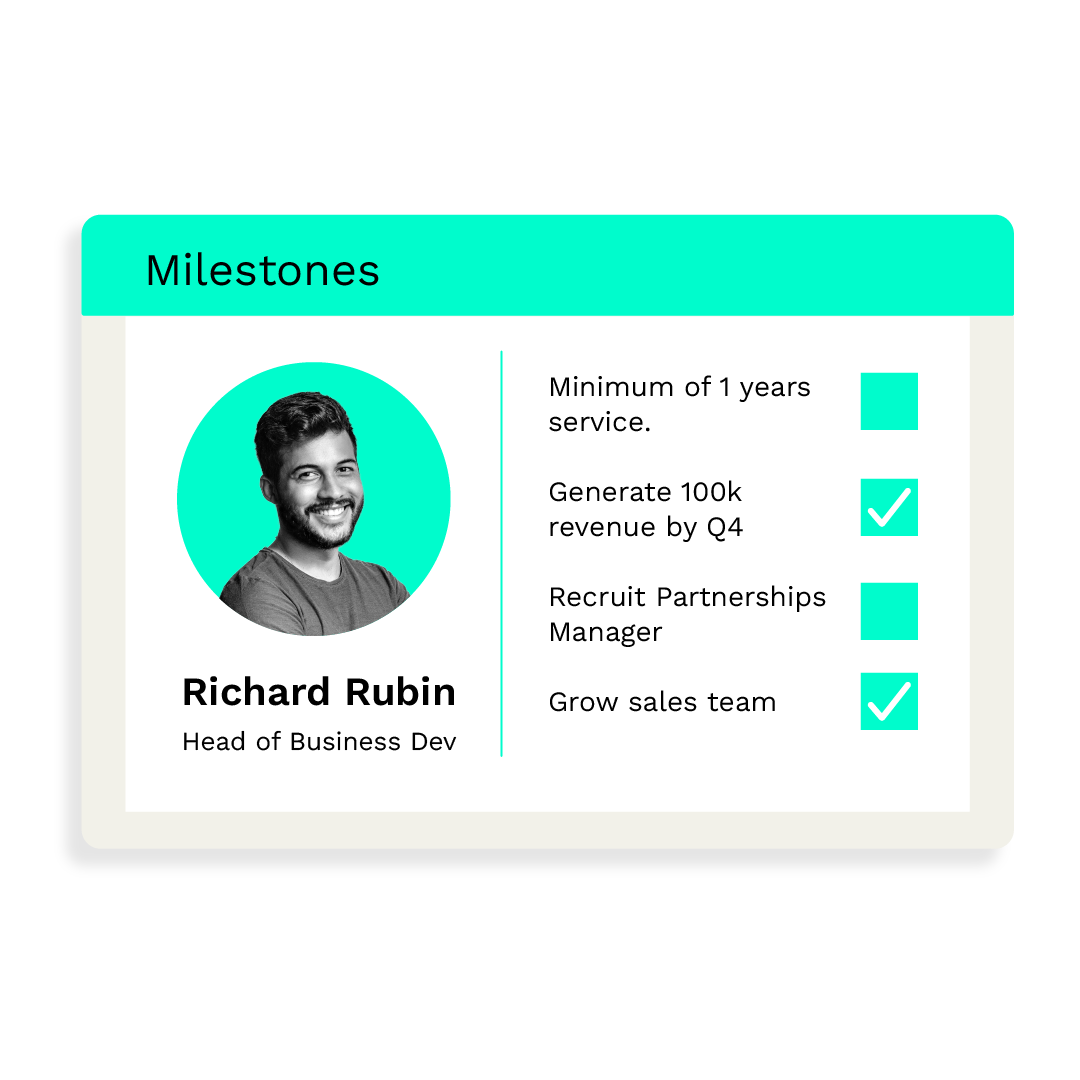

✓ You can set specific conditions for recipients

✓ Equity improves productivity and engagement

The old way involves lawyers and accountants. The new way is much more straightforward. You can issue stock options and shares directly via the Vestd platform, with automatic updates to Companies House.

There’s no one-size-fits-all approach, but here’s how UK startups and SMEs typically design their stock option plans:

Each company is different but there are a few proven pathways to follow. Here are a few fast facts about ESOPs:

✓ Average employee equity pools are c.18%

✓ Execs are twice as likely to get shares or options

✓ EMI schemes offer the best tax efficiency

✓ Growth shares are the most non-dilutive

✓ Unapproved options are fast and flexible

We'd love to learn about your business and goals, and demonstrate how our platform will transform the way you share, manage and track ownership.