Guided scheme design

Vestd provides UK companies with a fully guided service for founder, to help you avoid any pitfalls. You’ll always get five star support. Book a free consultation. to learn more.

Manage your equity and shareholders

Share schemes & options

Fundraising

Equity management

Start a business

Company valuations

Launch funds, evalute deals & invest

Special Purpose Vehicles (SPV)

Manage your portfolio

Model future scenarios

Powerful tools and five-star support

Employee share schemes

Predictable pricing and no hidden charges

For startups

For scaleups & SMEs

For larger companies

Ideas, insight and tools to help you grow

Book a demo

Founders tend to incentivise co-founders and key hires with equity, but sometime people walk away with a slice of the business before contributing what they promised. Agile Partnerships™ prevent this from happening, so nobody gets hurt. Setting one up costs a fraction of what lawyers typically charge.

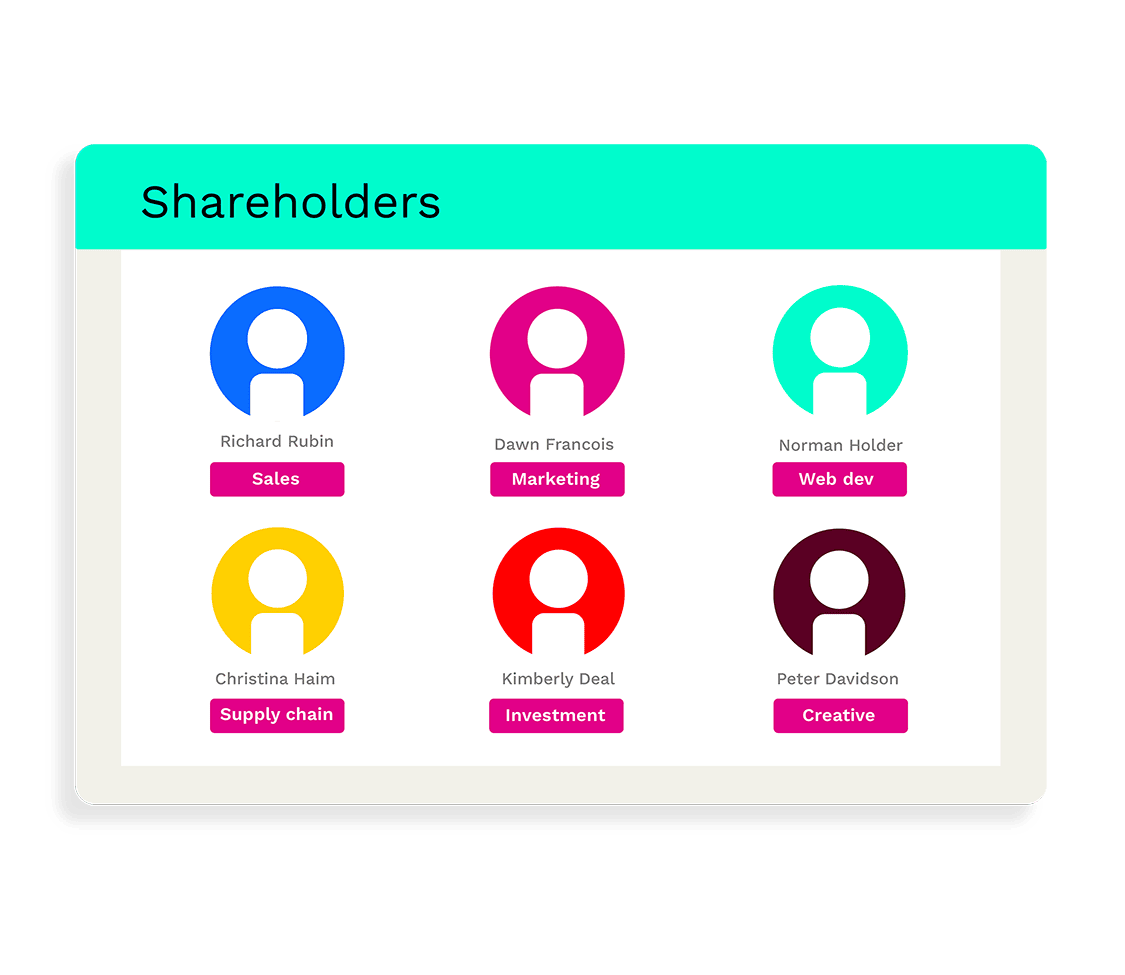

Establish some goals to determine how, when and what quantity of equity is released. People need to contribute fully to earn their maximum allocation of shares. Once the rules of the game have been decided everybody will know what is expected of them, and the size of the prize.

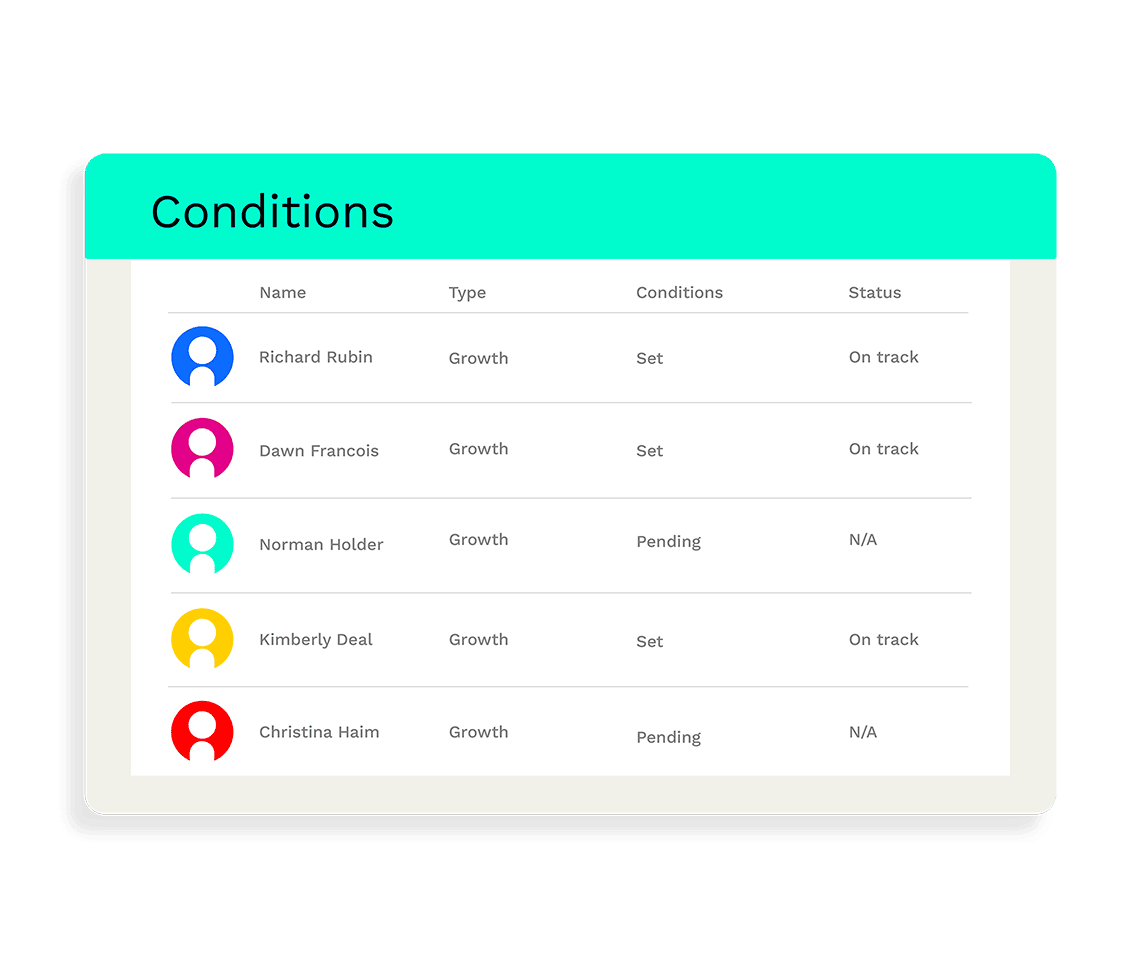

You can set conditions for co-founders, such as achieving milestones, or staying with the company for an agreed period of time, so long as your Articles of Association have been drafted to enable this. We’ll help you figure out the best conditions - what’s most important is that the criteria is clear and not subjective.

Vestd provides UK companies with a fully guided service for founder, to help you avoid any pitfalls. You’ll always get five star support. Book a free consultation. to learn more.

You can minimise your tax burden by choosing the best method of distributing equity within your partnership. We’ll outline the various share and option schemes available to you.

You can use the Vestd articles of association for free in the event that your articles don’t have the right provisions in place (to ensure that dilution and exits are handled correctly).

The platform itself allows you to manage all aspects of share and option management concisely in one place. The automations and integrations save you time. But while the platform is great, it is the team that makes Vestd stand out. From pre-sales to onboarding and the ever-helpful support team - not only do they support on the platform but provide excellent knowledge in this area.

Great platform. The team always provide brilliant support. I would definitely recommend using Vestd to anyone who needs to set up and administer an EMI scheme.

Straight forward and structured approach - so good for founders and also FD/CFO/advisor who is looking to get share capital and share option schemes in place.

A fantastic platform. The price is fixed. The customer support is fantastic and readily available. They have held our hand right through the whole process.

I love Vestd and I wish I had found it sooner. It makes the whole process of issuing shares whether they're growth shares or ordinary shares incredibly simple.

Amazing shift from Excel to Vestd. The support team were amazing and did a great job of completing our setup and we have been very pleased at being able to better manage our governance over time.

Thinking about giving your team some skin in the game?

We'll help you understand how to design a share scheme in next to no time. Calls are totally free and there's no obligation to use Vestd afterwards.

A founder prenup allows founders to spell out their business relationship in a contract which governs the release of equity based on what people actually bring to the party, as opposed to what they promise to bring. In the event that they part ways, the founder prenup helps founders reach a predetermined outcome.

65% of startups fail due to interpersonal tensions within the management team according to a study by Noam Wasserman, a Harvard Business School professor. While the best case scenario involves choosing a founder meticulously by asking the right questions, things can still go wrong. A founder prenup safeguards the business and determines the right rewards based on the founders’ contributions.

Agile Partnerships™ are bespoke equity-based agreements that tie equity rewards to agreed performance milestones. These agreements allow you to gradually release equity to key people (founders and other key employees), based on what they actually contribute. No more worrying about co-founders leaving with a big slice of the pie without fairly contributing to the business. They are most commonly used in the early stages of a business, but can also help when changing course, bringing new people into the company, or planning to exit and handover the company to new management.

Dividing equity equally between co-founders might seem like the fairest thing to do, but (ironically) it often breeds inequity, and sometimes, conflict. We’ve heard a few horror stories over the years of founders blindly agreeing to a 50/50 split only to regret it later after the other founder failed to deliver. There’s no one right answer to this. But we have put together a guide and tools to help you work out what’s right for your business. Ultimately, founding teams should base their decision on what each co-founder brings to the table.

Even the best planned businesses will sometimes need to change direction. Occasionally a bigger shakeup is required: new goals, new people, new terms.

Agile Partnerships allow you to get everybody aligned, so they know what the equity rewards will be if they deliver what has been agreed.

We designed Agile Partnerships based on real business needs. They are being used by UK startups and SMEs to ensure that people are rewarded fairly, and to avoid any sketchy scenarios. Here are the main benefits:

Fair and proportionate

Participating partners know the rules of the game, and what it takes to win.

Embrace fluidity

Use Agile Partnerships to make your equity structures less rigid.

100% transparent

Everybody knows what is expected of them, and the potential rewards.

Support good leavers

Sometimes people need a change of lifestyle, and you can help them adjust.

Define terms and milestones

You set the conditions and the equity allocation on a per person basis.

Improve your company culture

Delivery-based rewards and shared goals bring people together.

Bespoke for your business

Agile Partnerships are a customisable framework that will fit like a glove.

Incentivise future growth

Allow people to claim a slice of the action from this point forward.

Embrace generational change

Transfer equity to rising stars in a fair, performance-based way.