Guided scheme design

Vestd provides UK companies with a fully guided service for growth shares and other share schemes. You’ll always get five star support. Get started by booking a free consultation.

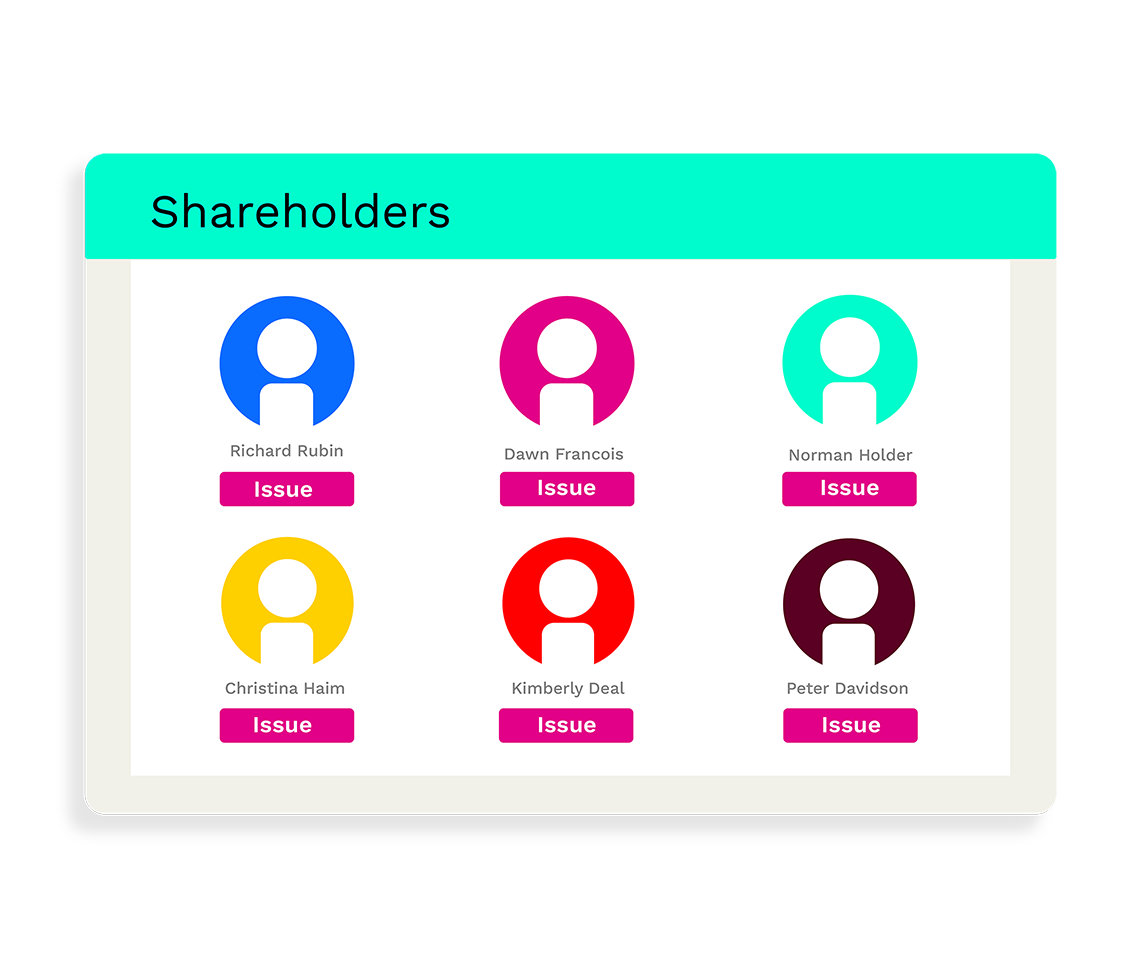

Manage your equity and shareholders

Share schemes & options

Equity management

Migrate to Vestd

Company valuations

Fundraising

Launch funds, evalute deals & invest

Special Purpose Vehicles (SPV)

Manage your portfolio

Model future scenarios

Powerful tools and five-star support

Employee share schemes

Predictable pricing and no hidden charges

For startups

For scaleups & SMEs

For larger companies

Ideas, insight and tools to help you grow

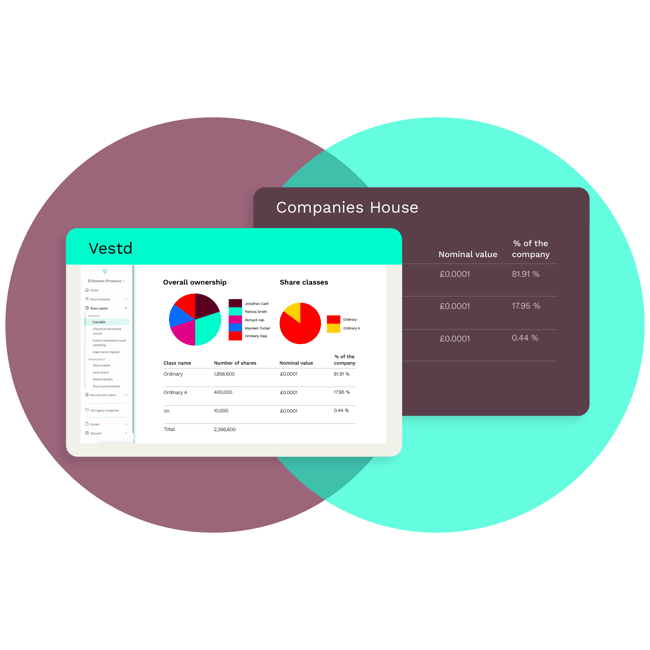

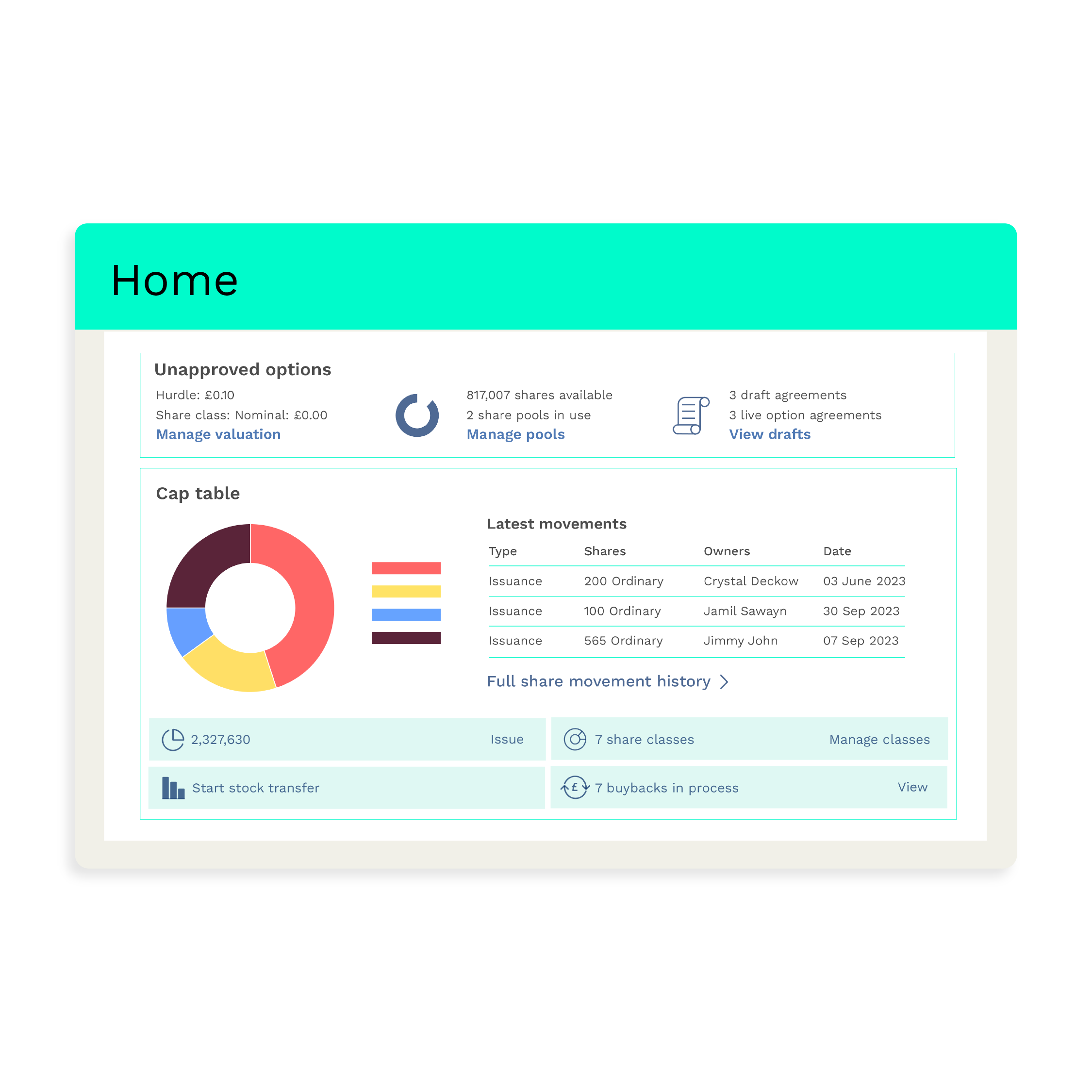

Leave your SH01 forms and shareholders resolution filing to us. Vestd automatically generates and submits all of your necessary paperwork with a two-way Companies House integration and a real-time digital cap table.

Book a free demo

Get ready-to-file forms that are generated automatically, to save time and reduce the risk of errors.

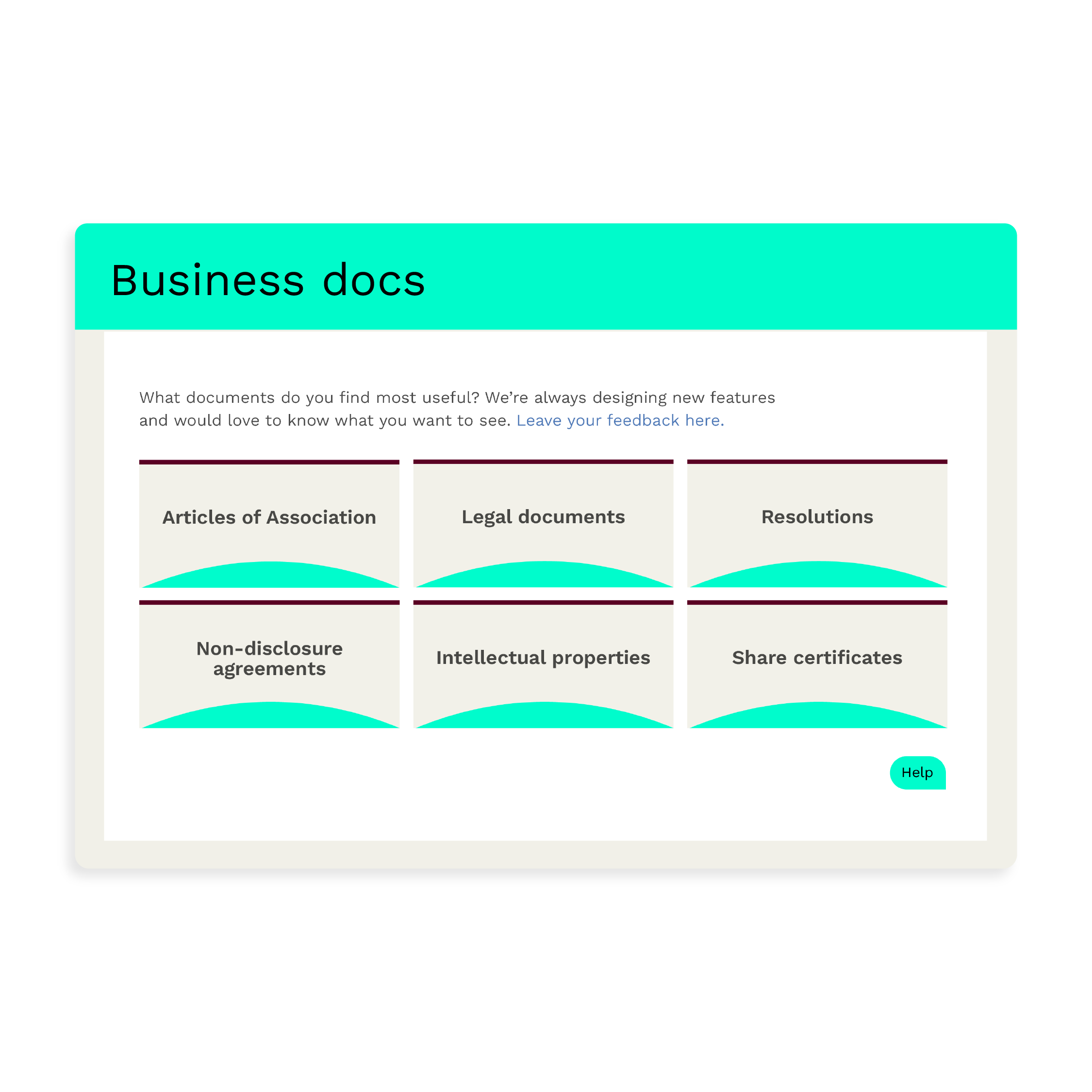

Manage your equity and shareholders digitally all in one place, without spending hundreds of pounds in legal fees.

Have a single source of truth for company ownership that’s updated in real-time with two-way Companies House integration.

Vestd provides UK companies with a fully guided service for growth shares and other share schemes. You’ll always get five star support. Get started by booking a free consultation.

Growth shares are issued at a hurdle rate, which is typically a small premium above the company’s current value. We will provide you with an up-to-date, defensible valuation.

You can use the Vestd articles of association for free in the event that your articles don’t have the right provisions in place (to ensure that dilution and exits are handled correctly).

The platform itself allows you to manage all aspects of share and option management concisely in one place. The automations and integrations save you time. But while the platform is great, it is the team that makes Vestd stand out. From pre-sales to onboarding and the ever-helpful support team - not only do they support on the platform but provide excellent knowledge in this area.

Great platform. The team always provide brilliant support. I would definitely recommend using Vestd to anyone who needs to set up and administer an EMI scheme.

Straight forward and structured approach - so good for founders and also FD/CFO/advisor who is looking to get share capital and share option schemes in place.

A fantastic platform. The price is fixed. The customer support is fantastic and readily available. They have held our hand right through the whole process.

I love Vestd and I wish I had found it sooner. It makes the whole process of issuing shares whether they're growth shares or ordinary shares incredibly simple.

Amazing shift from Excel to Vestd. The support team were amazing and did a great job of completing our setup and we have been very pleased at being able to better manage our governance over time.

Our equity consultants speak with hundreds of founders every month. We’d love to help you too.

Book a free call to explore:

Giving people skin in the game used to be complicated but we’ve made it really straightforward. Choose a time and let’s chat.

.png?width=499&height=108&name=Capterra%20G2%20B%20Corp%20Dark%20(1).png)

We'll use your details to contact you with more information about Vestd and the work we do.

The SH01 form, also known as the "Return of Allotment of Shares", refers to the form that is used to notify Companies House of an allotment of shares by a company. When your company issues new shares, it must complete and file this form with Companies House within one month of the allotment date. The form provides details about the company, the new shares being issued, and the shareholders who will receive them. It is a legal requirement under the Companies Act 2006 for all businesses registered in the UK to file this form with Companies House.

Each time your business alots new shares, you're legally required to submit a SH01 form with the Companies House. The form must be filed within 30 days of alottment of new shares.

Vestd automatically generates and submits the form to Companies House. However, if you want to file an SH01 form yourself, you will need to follow these steps:

Step 1: Obtain the necessary information. You will need to have the following information on hand before filing the SH01 form:

Step 2: Fill out the SH01 form. You can fill out the SH01 form online using the Companies House website or you can download and print the form from the website and fill it out manually. The form asks for the above-mentioned information along with some additional details like the names and addresses of the shareholders and the total amount paid or due to be paid for the shares.

Step 3: Pay the filing fee. The filing fee for an SH01 form is currently £10 if filed online or £40 if filed by paper. You can pay the fee using a debit or credit card, or you can set up an account with Companies House and pay by direct debit.

Step 4: Submit the form. Once you have completed the SH01 form and paid the filing fee, you can submit the form online or by post to Companies House. If you submit the form online, you will receive a confirmation email. If you submit the form by post, you should include a cheque or postal order for the filing fee and allow extra time for processing.

Once your company issues new shares, you must complete and file this form with Companies House within 30 days of the allotment date.

Yes. The form must be completed and signed by a director or company secretary of the company. The SH01 form must also be completed accurately and in full, including the details of the company's share capital and shareholders. Failure to do so may result in delays in the registration process or even rejection of the application.

Yes. Companies House accepts all these types of electronic signatures, provided they meet the relevant legal requirements.

Filing the SH01 form late can result in:

If you are having trouble filing the form or need more time, you may be able to apply for an extension or get professional advice from a qualified accountant or solicitor.