The EMI specialists

Set up, launch and manage your entire Enterprise Management Incentive scheme with expert support. We know our stuff.

Manage your equity and shareholders

Share schemes & options

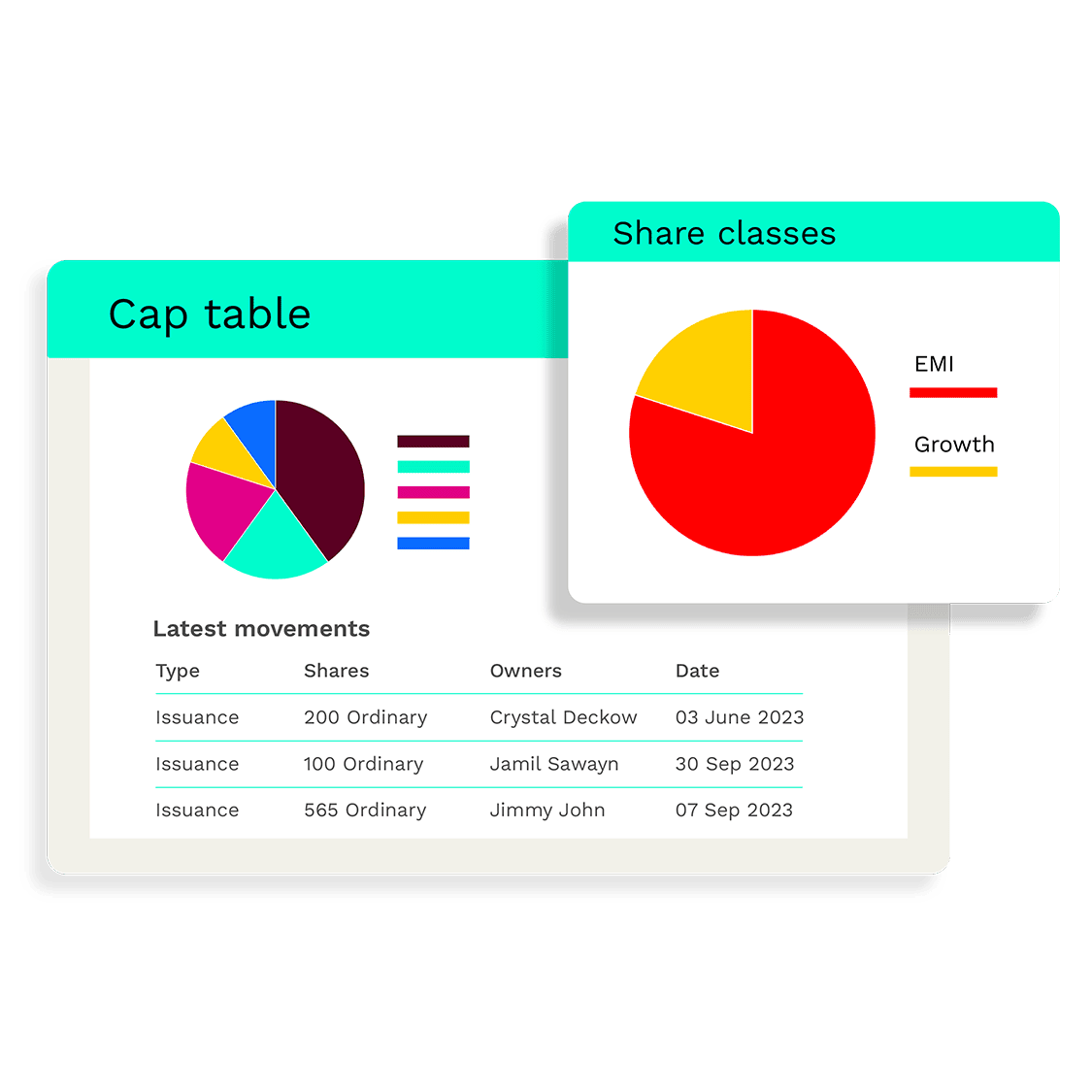

Equity management

Migrate to Vestd

Company valuations

Fundraising

Launch funds, evalute deals & invest

Special Purpose Vehicles (SPV)

Manage your portfolio

Model future scenarios

Powerful tools and five-star support

Employee share schemes

Predictable pricing and no hidden charges

For startups

For scaleups & SMEs

For larger companies

Ideas, insight and tools to help you grow

Enterprise Management Incentive (EMI) schemes are one of the most powerful ways to reward employees with equity. Vestd helps you launch and manage an EMI scheme from start to finish with expert support and full compliance.

EMI (Enterprise Management Incentive) schemes are government-approved share option plans that let you give employees equity in a tax-efficient way. They're designed to help growing UK companies attract and retain talent by offering team members a real stake in your business.

Vestd is the UK’s most advanced EMI platform, helping companies launch and manage share schemes the right way.

Vestd is the most advanced digital platform for creating, setting up and managing EMI schemes, with full two-way Companies House integration. These schemes are one of the most powerful employee benefits available to high-growth companies.

UK companies operating tax-advantaged EMI schemes

The number of individuals who are granted EMI options annually.

The amount of annual income tax relief from share schemes.

Set up, launch and manage your entire Enterprise Management Incentive scheme with expert support. We know our stuff.

Vestd is an FCA regulated and authorised platform. Helping UK companies reward their teams with tax-efficient share schemes.

HMRC needs one before you start a scheme, and also in the future as the company grows. We offer defensible valuations as part of the service.

.png)

Total EMI management: the only platform with two-way Companies House integration. Start an EMI scheme from scratch using our platform.

Legal docs and templates: we provide you with all of the essential business docs needed.

Lifetime support: our team of 70+ EMI experts on hand to help you with your every need. No robots, real humans.

Guided scheme design: you can design individual agreements for each team member, creating a tailored employee incentive that reflects their contribution. We're big on 'conditional equity'.

Issue shares instantly: authorise and issue new shares digitally, and update Companies House in the click of a button. No paperwork involved!

Dynamic shareholder dashboards: invite recipients to shareholder dashboards, to allow to track the value of their equity.

The Enterprise Management Incentive scheme (EMI) is a tax-advantaged share option scheme specifically designed for UK-based startups and SMEs. First set up in 2000, EMI has become the most widely used HMRC backed share incentive scheme. EMI helps companies attract and retain key staff by rewarding them with equity in the business.

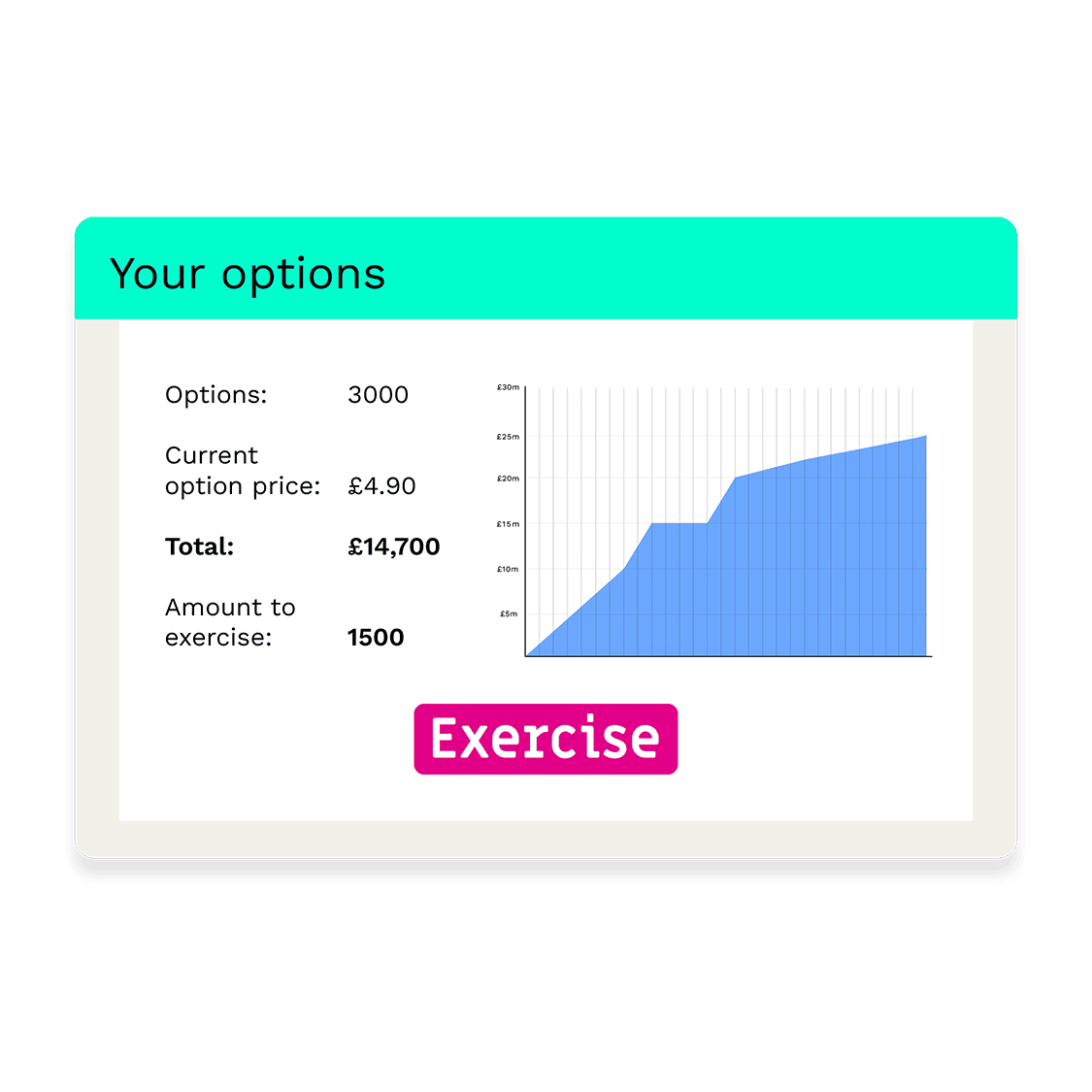

EMIs give employees the option (i.e. the right) to buy shares in a company at an agreed price after meeting certain requirements, e.g. performance and/or service period. The agreed price can be the AMV at the time of grant or a discounted value (Read more about taxation and exercise here). EMI schemes are flexible as conditional milestones and custom vesting schedules can be set to determine the release of equity. They're also incredibly tax-efficient for employees.

Yes. You can easily offset the costs of setup against tax. The Corporation Tax deductions will be equal to the employee’s gain when the options are exercised. In the event that the exercise price equals the market value, the Corporation Tax deduction would equal what would have been taxed without the EMI scheme relief.

There are no upfront tax costs and they are low risk due to the flexibility for designing an option scheme. Poorly-designed schemes - typically those that are overly complicated - can cause headaches. Conditions such as goals and milestones should be tangible and measurable. About half of the existing EMI schemes we see are in some way non-compliant, which can lead to recipients having to pay more tax than is necessary - these schemes must be managed appropriately. Additionally, if the employee leaves before the EMI option is exercised and good/bad leaver clauses are in place then options can lapse and this will leave the employee with no further rights under the scheme. The scheme design and structure are formalised as a legally-binding shareholder agreement.

Data shows that employees are more likely to feel aligned with the interests of shareholders and the board if they have a tangible interest in the company’s ownership. That’s why share options are popular with growing companies who can offer them to attract talented staff. Additionally, EMI schemes are highly tax efficient for both the business and the employee as tax is only incurred on the value of schemes when they're awarded and not at the point they're exercised. While employers get tax deductions, an employee's fully vested EMI shares are eligible for Business Asset Disposal Relief, which means they’re only charged 10% Capital Gains Tax (not the standard 20%) at the time of the sale.

Vestd is an FCA-regulated, digital employee share scheme platform which eliminates the paperwork and reduces the hassle of managing share schemes. Schedule your free, no-obligation consult with us to learn how we can help your business grow.

EMI options are a type of tax-advantaged share option granted to employees as part of an Enterprise Management Incentive scheme. They give team members the right to acquire shares in the company at a set price in the future.

We'd love to learn about your business and goals, and demonstrate how our platform will transform the way you share, manage and track ownership.