Why do companies give employees shares?

Last updated: 17 April 2024

Manage your equity and shareholders

Share schemes & options

Equity management

Migrate to Vestd

Company valuations

Fundraising

Launch funds, evalute deals & invest

Special Purpose Vehicles (SPV)

Manage your portfolio

Model future scenarios

Powerful tools and five-star support

Employee share schemes

Predictable pricing and no hidden charges

For startups

For scaleups & SMEs

For larger companies

Ideas, insight and tools to help you grow

When you’re trying to work out which share scheme or share option scheme is best for your business, it’s hard to fight the urge to Google ‘last-minute holidays’ instead.

You could go straight ahead and use our Complete Guide to Setting Up a Company Share Scheme, which is pretty much as fun as a last-minute holiday anyway!

Perhaps because even when you’re learning about tax efficiency, just the word ‘tax’ implies so much effort and brainpower is required that it’s usually followed by a mumbled excuse to leave the room. When you’ve got a team which is a mix of employees, contractors and freelancers, share schemes can seem even more daunting. Do you need more than one? Will that cost you more money?

It doesn’t have to be complicated

The first step is identifying the type of scheme best suits your business’ unique needs. Have a think through these questions.

Do you want to give shares to employees?

Do you want to give shares to non-employees?

A mixture of both?

Do you need a scheme for giving shares to investors?

Do you want to set conditions for your shares?

The table of share schemes

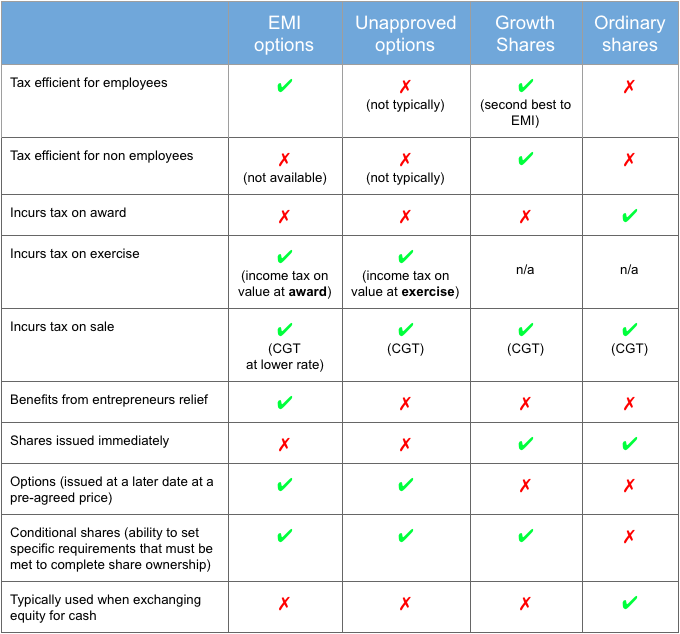

If you’re not completely sure of your answers that doesn’t matter, the table below is a good place to start to figure out what share schemes are available, and which best suit certain circumstances.

For example, if you want to give shares to employees then the EMI option share scheme is the most tax efficient plan, followed by growth shares ✔. Or, if you want to set conditions for your shares you can see that ordinary shares don’t make the cut ✗.

If you have any questions about which share scheme would suit your business’ the Complete Guide to Setting Up a Company Share Scheme is the best place to start.

Last updated: 17 April 2024

Last updated: 19 April 2024

This blog is more than four years old. Some information may no longer be current. One in four UK-based SMEs now share ownership with some or all of...