Incorporated Company

Even if you've recently set up a UK limited company, you can still sign up to Launch. Let us show you how in four simple steps.

Talk to an expert1) Book a call and sign up

Book a call with one of our equity specialists to get started. Once you’re set up on the platform, we can link your existing company’s details.

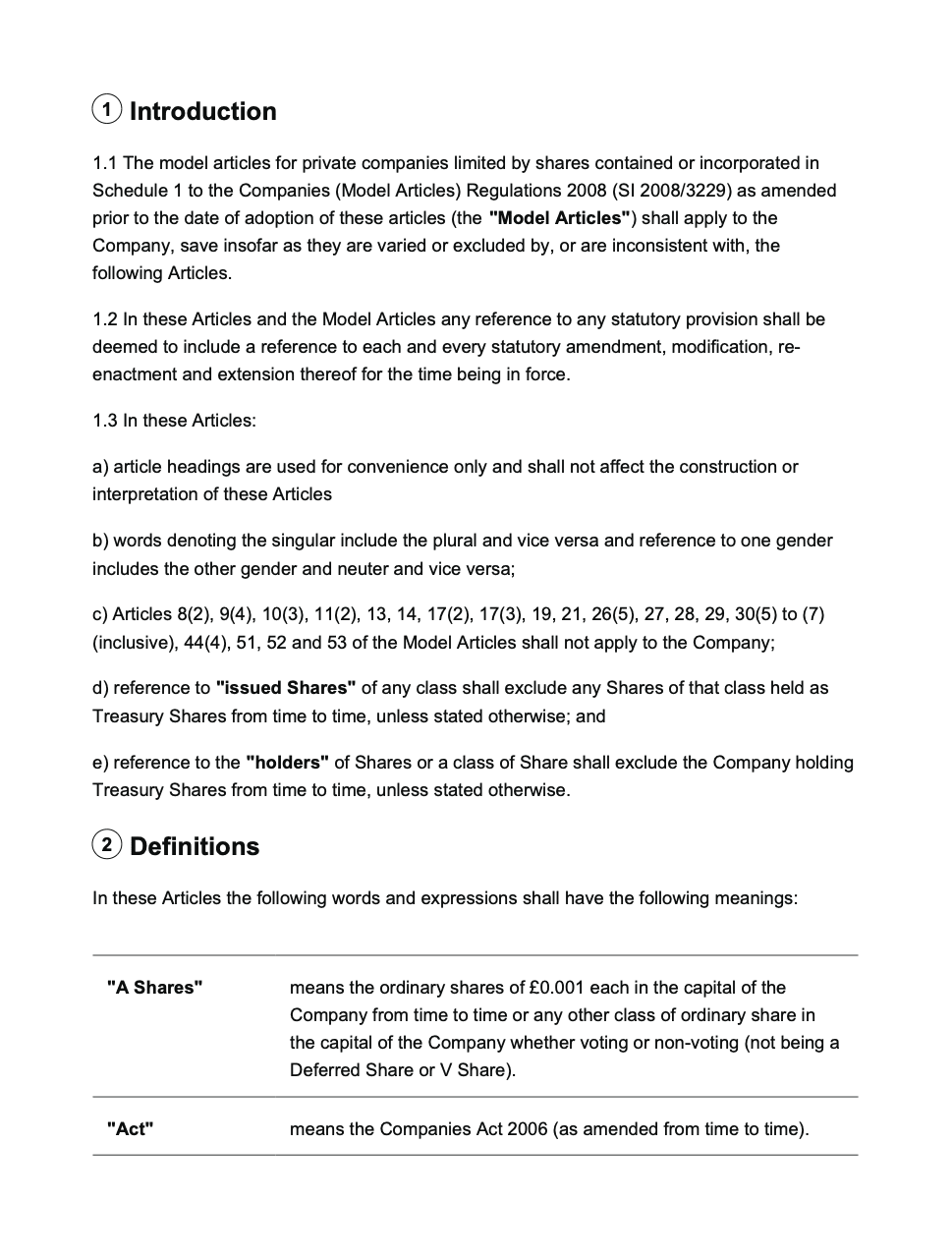

2) Adopt Vestd Articles of Association

If you’ve already incorporated, the chances are you did this with the standard model articles generated by the Companies House registry. That’s fine, but these articles leave a lot to be desired:

- No ‘drag & tag’ clauses

- No ‘good leaver’/‘bad leaver’ clauses

- No conditional equity

Our best-in-class articles are based on the British Venture Capital Association’s and address these problems to set you up to succeed. You’ll need to obtain a special resolution to adopt our articles. Just let your equity consultant know and they will generate the resolution during your onboarding.

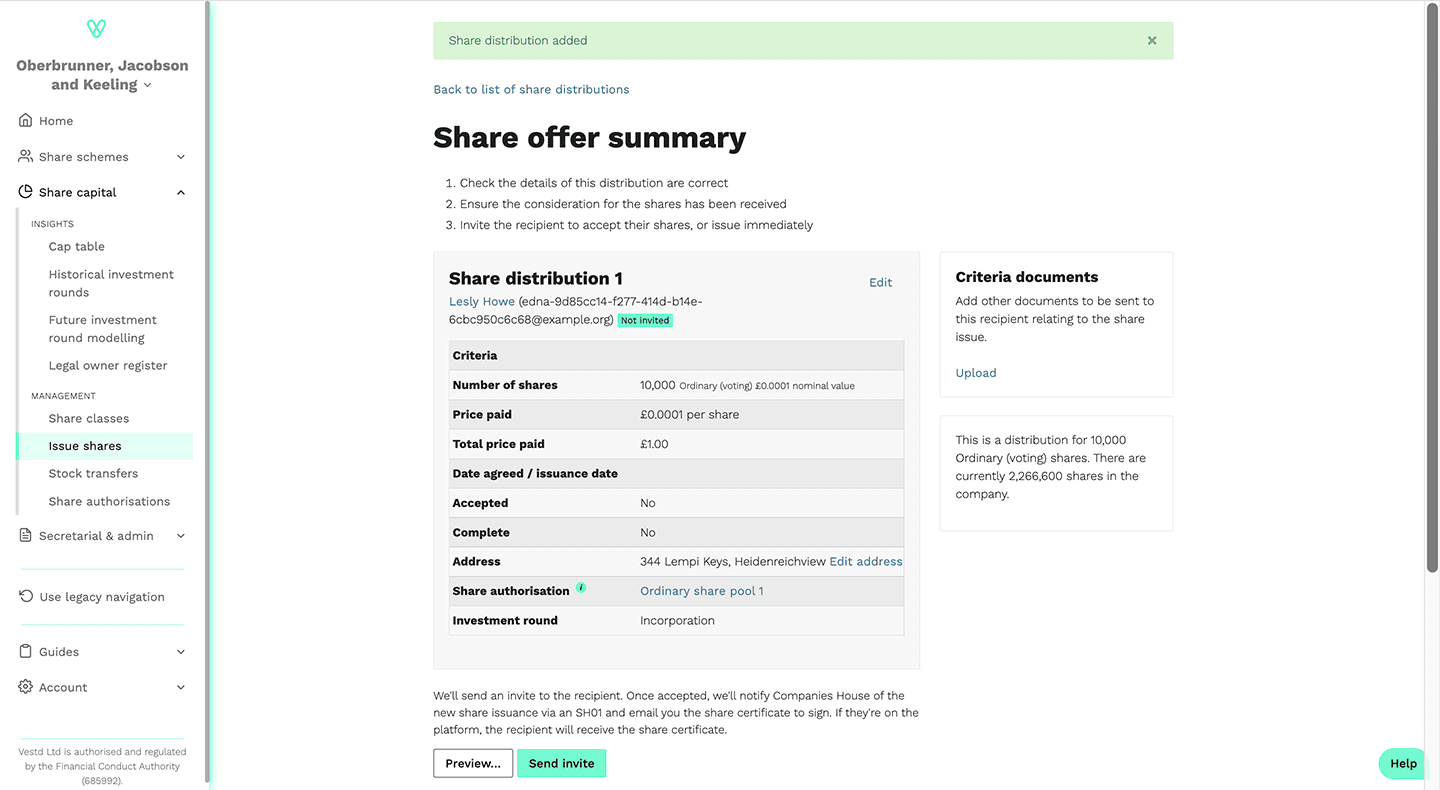

3) Amend shareholders & directors

Most companies incorporate with a small number of shares. However, this makes your capital structure illiquid (you can only give away one share at a time).

What if you want to give people fractions of a percent? The platform makes it easy to subdivide your current shareholding, increase your capital structure and add shareholders.

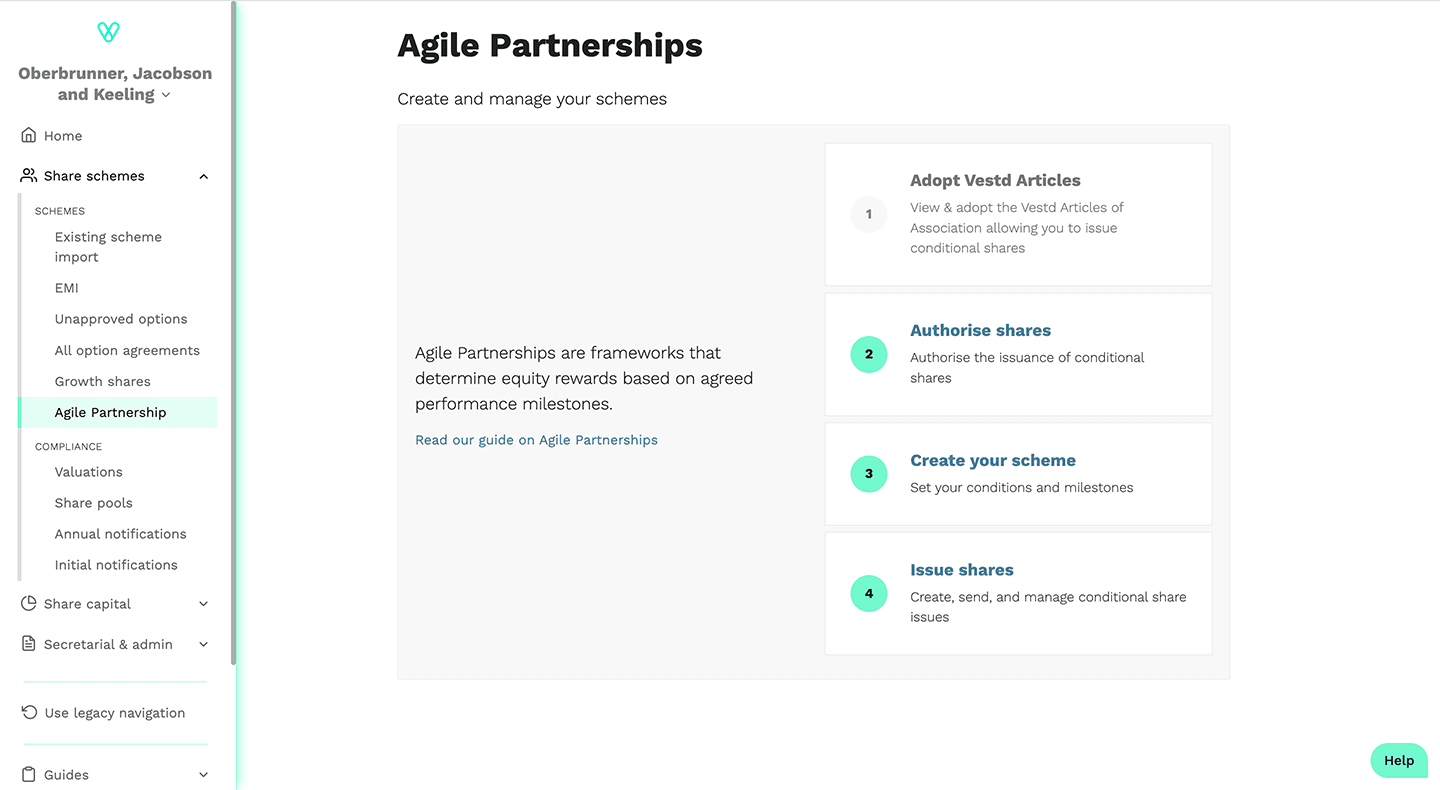

4) Design your Agile Partnership

Ordinary shares are fine, but they are incredibly difficult to take back once issued, so if one of your co-founders leaves or fails to perform, they could walk away with equity they didn’t earn. Agile Partnerships use conditional (growth) shares for greater flexibility and peace of mind. equity with strings attached. Think of it like a ‘founder prenup’.

For fairness and transparency, agree on specific, measurable and tangible conditions. For instance, deliver a project by X, X number of sales etc. Check out our conditional equity milestones guide for examples.

Only once these milestones are completed will their shares become unconditional. If they fail to meet expectations, either totally or partially, their shares are deferred (which effectively means cancelled). The result is a cap table that changes over time in accordance with people’s contributions.