Improve tax-efficiency

Offset the whole cost of a Vestd share scheme against corporation tax.

Manage your equity and shareholders

Share schemes & options

Equity management

Migrate to Vestd

Company valuations

Fundraising

Launch funds, evalute deals & invest

Special Purpose Vehicles (SPV)

Manage your portfolio

Model future scenarios

Powerful tools and five-star support

Employee share schemes

Predictable pricing and no hidden charges

For startups

For scaleups & SMEs

For larger companies

Ideas, insight and tools to help you grow

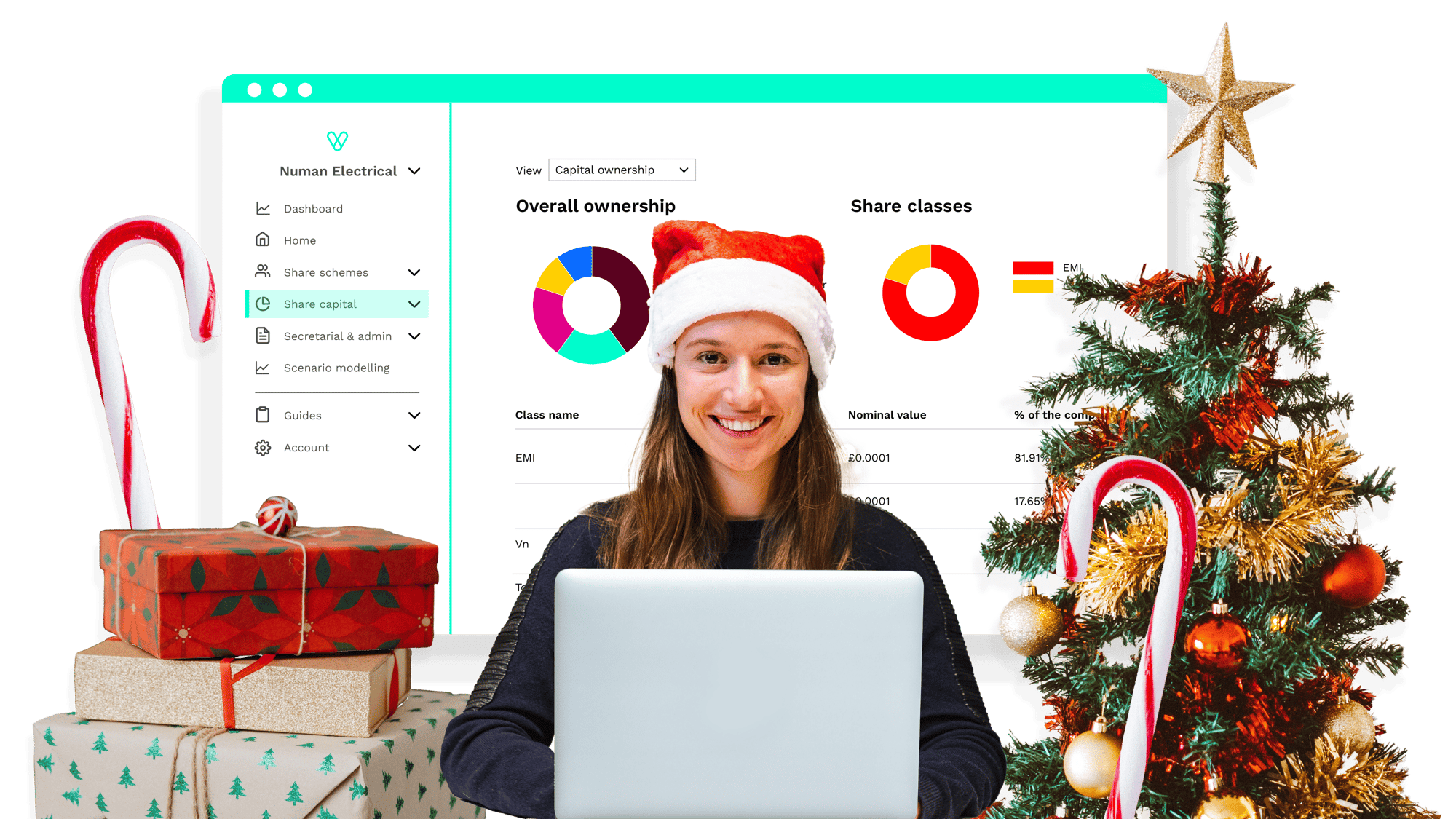

Give the gift of an Enterprise Management Incentive scheme this Christmas and reward your merry team with equity.

Get started

"The idea was to set up an EMI share scheme so that everyone could share in the value of the company and the result was pretty much all of the team paid off their mortgages"

Offset the whole cost of a Vestd share scheme against corporation tax.

Share schemes are proven to increase employee retention.

Conditional equity agreements get the best out of your team and helps you hit your growth targets.

Employees who have equity tend to work harder, because they have a vested interest.

It's a costly and lengthy process to replace leavers. Sharing equity gives them a reason to stay.

When employees feel included in the success of the business, the more they’re motivated to contribute.

Issue shares and options directly via the platform with unlimited shareholders, flexible pricing, legal docs, valuations and a real-time digital cap table. There’s no need for any paperwork: it is all done on Vestd.

✓ Specific conditions can be set for recipients

✓ The tax advantages are huge

✓ Companies can offset the costs

✓ They are used to motivate and align employees

As one of HMRC’s tax-advantaged schemes there are certain eligibility requirements that must be met:

✓ A formal valuation is needed (we’ll provide one)

✓ Options are for employees only

✓ Companies must be small or mid-sized

You can check your EMI eligibility via our quick quiz.

Vestd is hands down the easiest way to reward key people with Enterprise Management Incentives.

✓ Start a scheme from scratch

✓ Scheme design and set up assistance

✓ Issue options and shares digitally

✓ Create dynamic vesting schedules

✓ Add custom conditions for each recipient

✓ Easily add and remove people

✓ Give shareholders their own dashboard

Save time and avoid expensive mistakes with Vestd. We'll help set up an EMI scheme so that you can announce it to your team for Christmas.