Set up your UK limited company with Vestd

Three simple steps. That’s all it takes to set up your UK limited company using Vestd and design conditional equity agreements that set your business up for success.

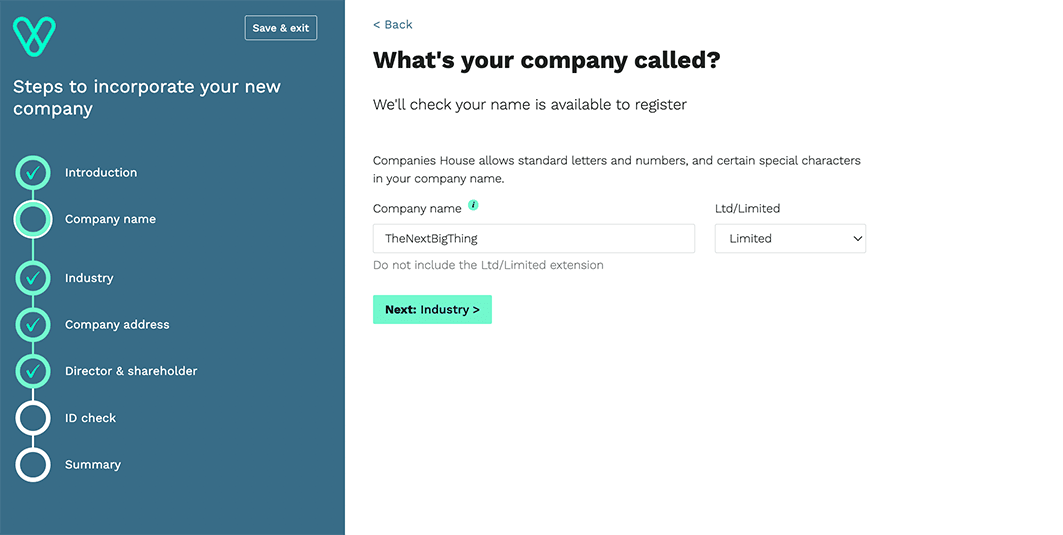

1) Create your Company

It’s time to stop dreaming and start doing.

The first step to make things official is to incorporate. That is, to register your UK limited company with Companies House. The most common type of company to incorporate is a private company ‘limited by shares’.

This legally separates ‘you’ from ‘the business’ and allows you to sell shares in exchange for capital. However, there are a few hoops to jump through first to get there.

Launch leads you through this process, creating a company with a starting capital of one ordinary share with a nominal value of £0.000001 along with the single director and shareholder as required by law.

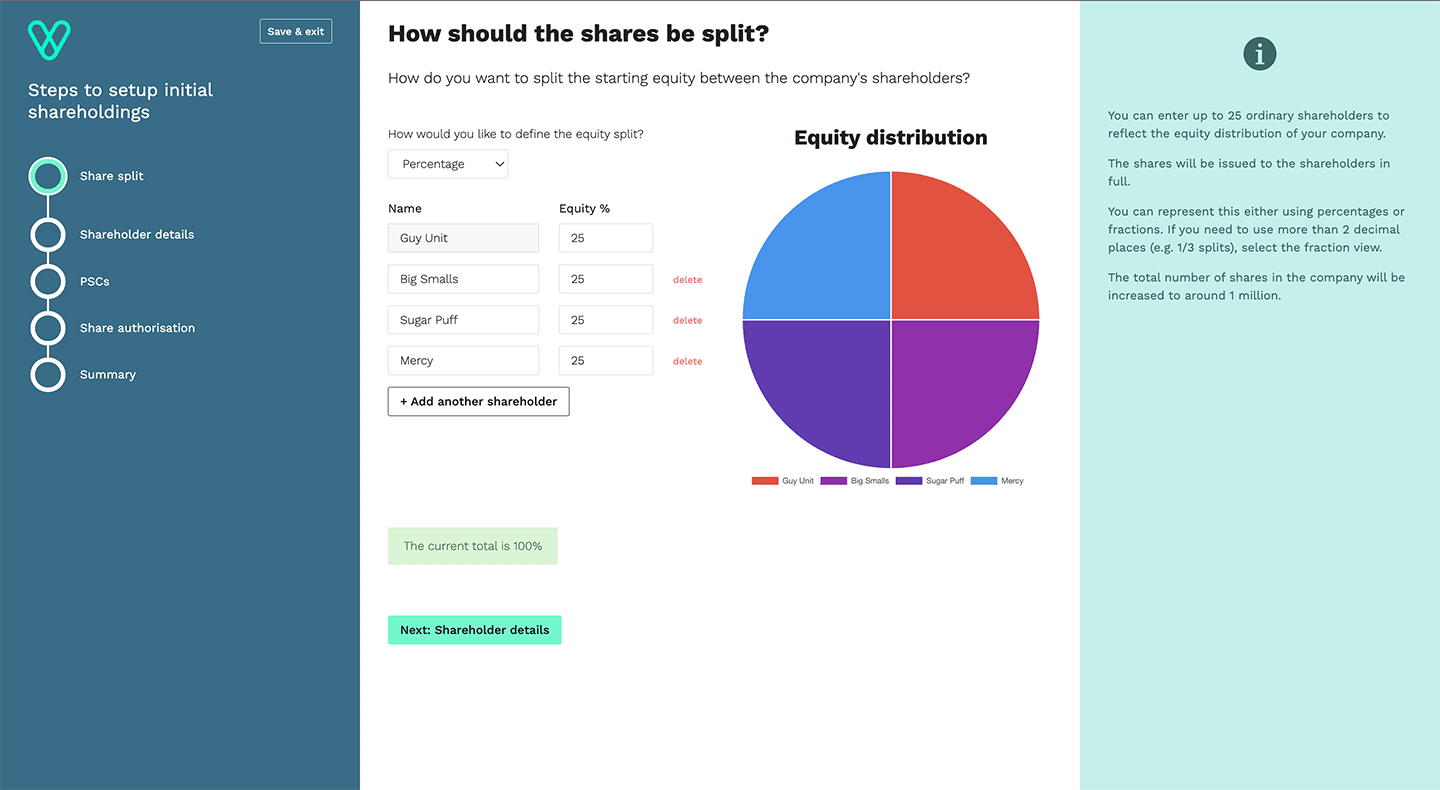

2) Assign ordinary shareholders & directors

The chances are you will want more than one single share, so we’ll increase the shareholding to make a more liquid capital structure, capable of being divided into smaller parts - one million shares, which will be allocated both to you and your founding team, as you see fit.

But remember, these are ordinary shares, they are not conditional on anyone completing key milestones or delivering on promises, so allocate with caution!

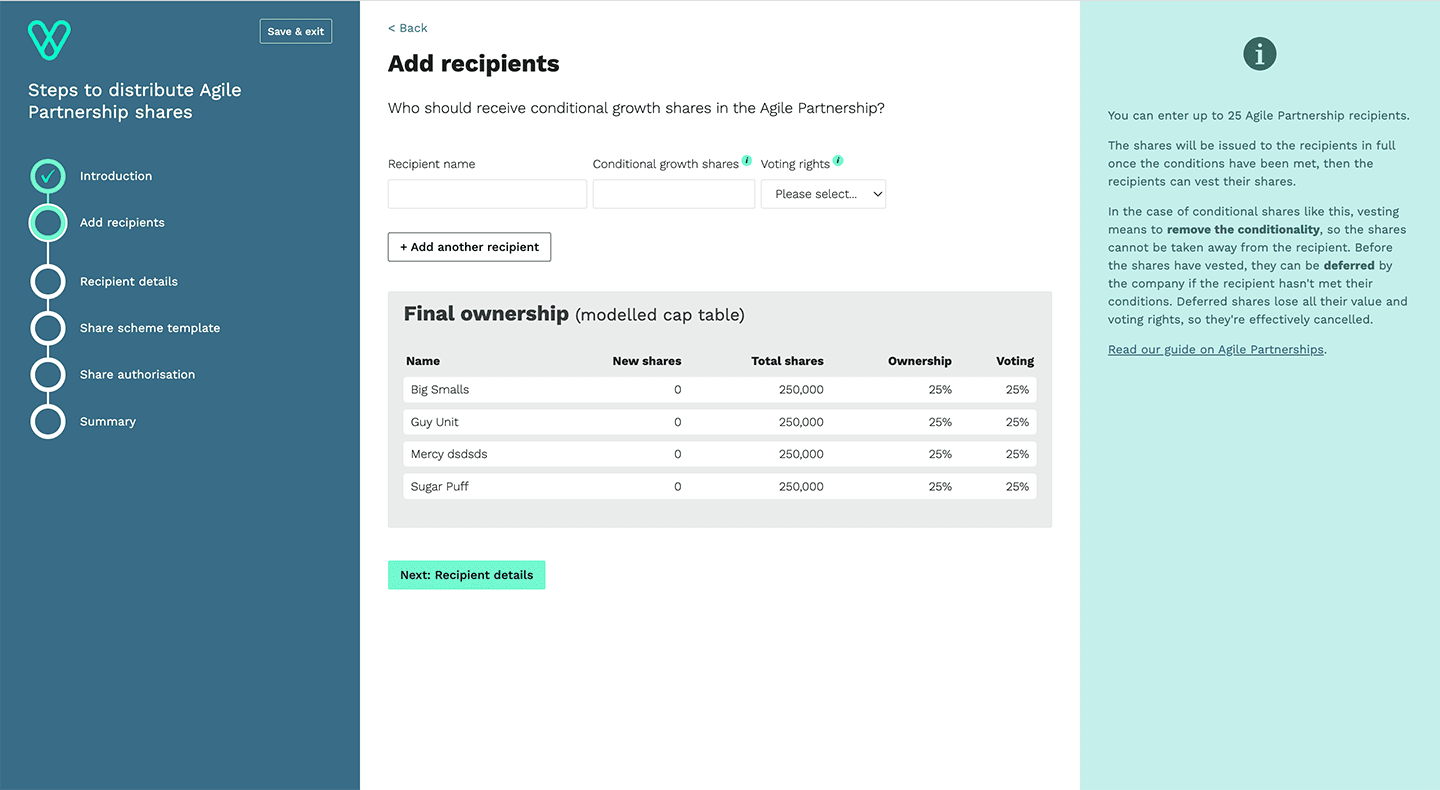

3) Design your Agile Partnership

Ordinary shares are fine, but they are incredibly difficult to take back once issued so if one of your co-founders leaves or fails to perform as promised then you’re stuck! That’s why Agile Partnerships use conditional (growth) shares; equity with strings attached.

First, agree what each team member will bring to the table. E.g. delivery of a project, number of sales, years of service etc. Download our conditional equity milestones guide for examples. Then issue conditional shares based on the completion of these milestones.

Only then will their shares become unconditional. If they fail to meet expectations, either totally or partially, their shares are deferred accordingly (effectively cancelled). The result is a dynamic cap table that changes over time in line with people’s contributions.

Frequently asked questions

-

What do you need to get set up?

- Company name

- Address

- Passport or form of ID

- At least one shareholder and director

-

What will my company be like after set up?

You will have a UK-registered company limited by shares. Your company will have 1 million shares of £0.000001.