Share schemes & equity management for startups, scaleups and established UK companies.

Get started

Get started

Manage your portfolio with ease and evaluate potential investments.

Manage

Manage

Add your investments for complete visibility of your shareholdings. View cap tables and detailed share movements.

Model

Model

Explore future value scenarios based on various growth trajectories, to figure out potential payouts.

SPVs

SPVs

Set up and manage new SPVs without leaving the platform, then invite co-investors to fund and participate.

Platform

Use cases

Read more reviews >

Support

The Joy of Enterprise Management Incentives

Read our free guide to the UK's most tax-efficient share scheme.Get the guide

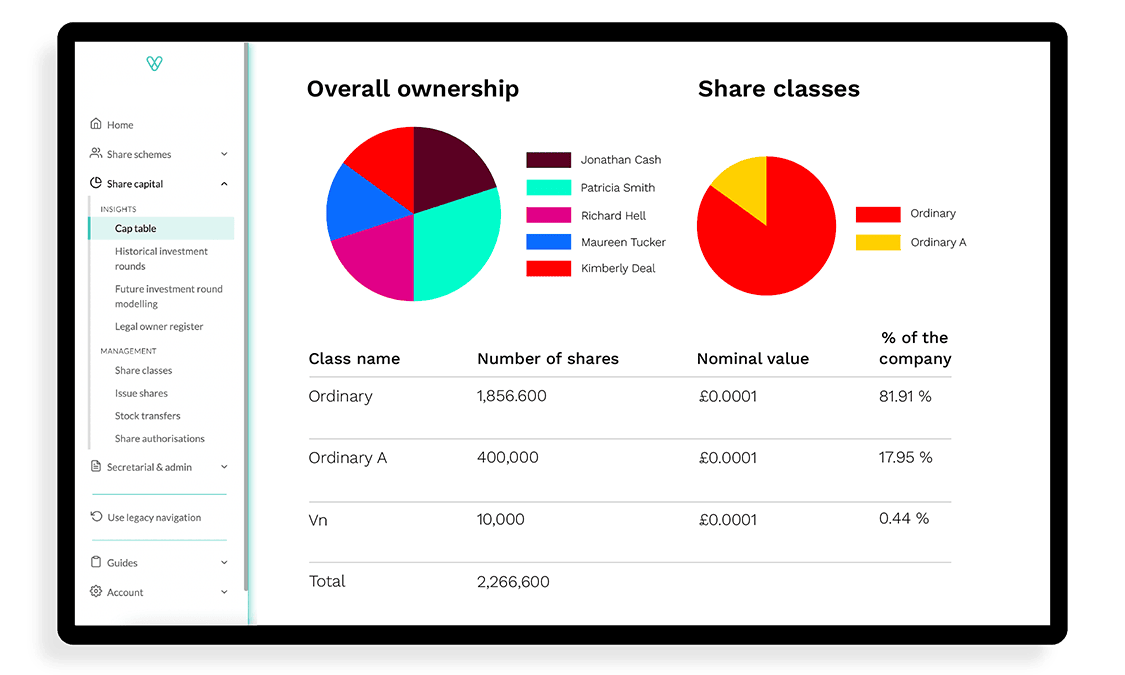

The cap table management platform

A real-time, 100% accurate digital cap table.

Trusted by thousands of founders

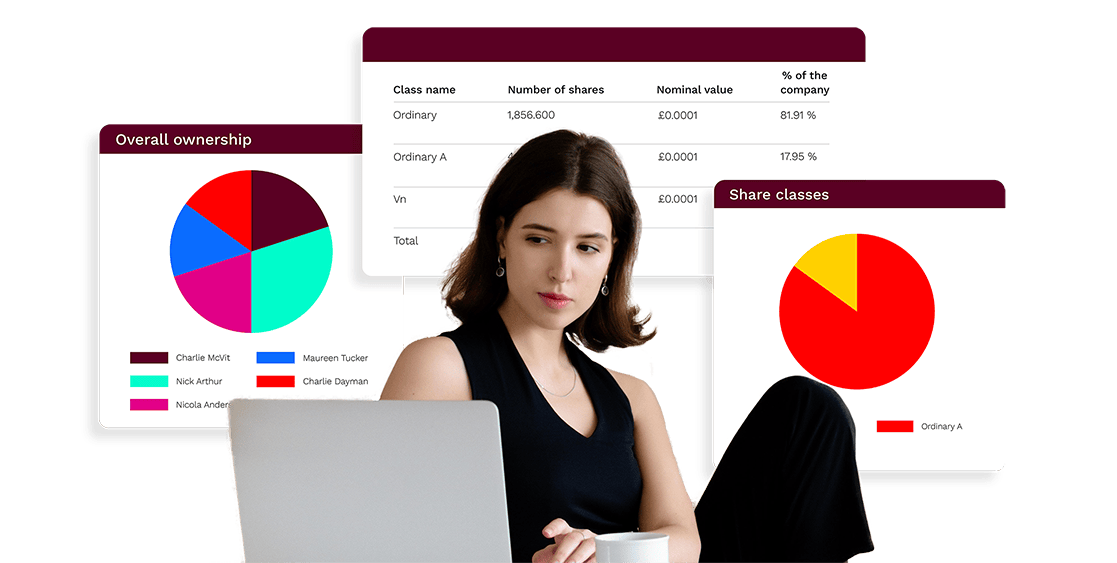

An accurate view of ownership

Our cap table management platform is purpose built for UK startups and SMEs to get a clear view of company ownership.

✓ A truly real-time, 100% accurate digital cap table.

✓ Full, two-way Companies House integration.

✓ Forecast future scenarios and model the impact of investment rounds.

.png?width=2250&height=1584&name=Cap%20Table%20(1).png)

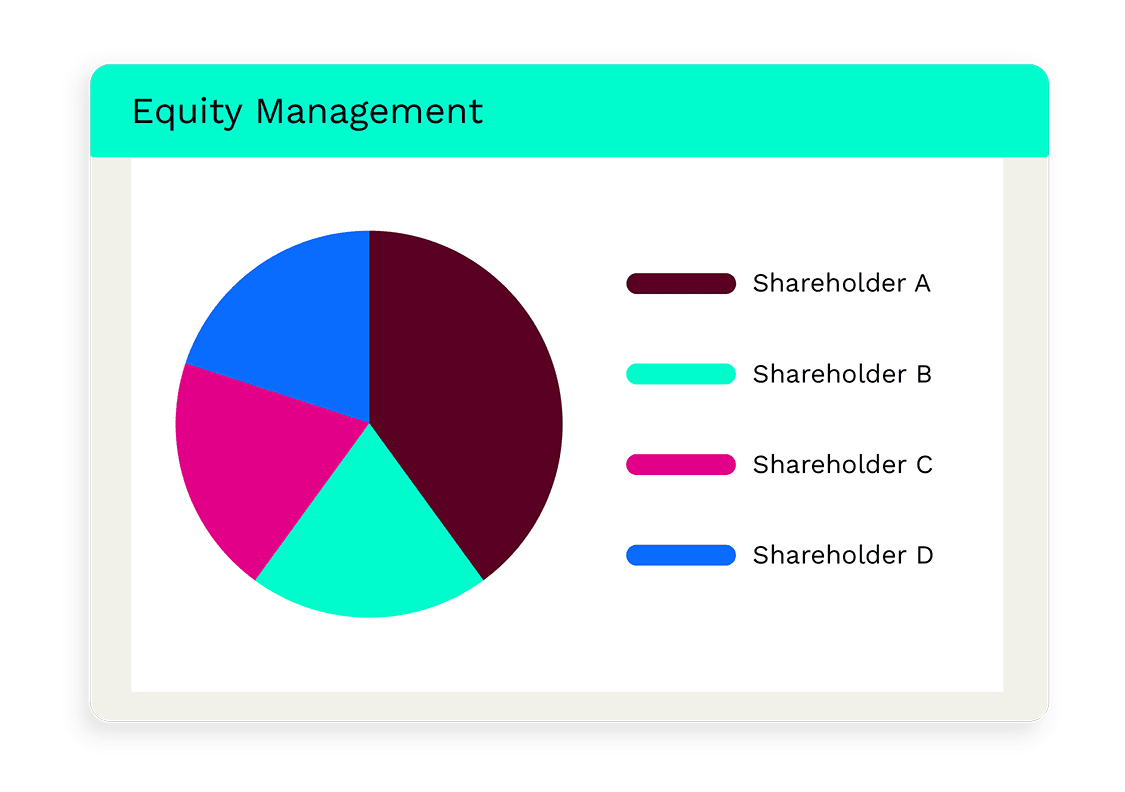

Manage equity with ease

Designed to be your single source of truth with clear visibility of issued and outstanding capital.

✓ Get a clear and simple dashboard for all your cap table needs.

✓ Authorise your share pool and issue share certificates.

✓ Stay compliant with guided setup and ongoing support.

Designed for peace of mind

The UK’s only FCA authorised and regulated cap table management platform.

✓ Automate HMRC notifications.

✓ Access safe, fast & accurate equity reports.

✓ Instantly issues shares and options.

.png?width=2484&height=1744&name=Group%20695%20(1).png)

The UK's most advanced cap table management platform

The platform itself allows you to manage all aspects of share and option management concisely in one place. The automations and integrations save you time. But while the platform is great, it is the team that makes Vestd stand out. From pre-sales to onboarding and the ever-helpful support team - not only do they support on the platform but provide excellent knowledge in this area.

Great platform. The team always provide brilliant support. I would definitely recommend using Vestd to anyone who needs to set up and administer an EMI scheme.

Straight forward and structured approach - so good for founders and also FD/CFO/advisor who is looking to get share capital and share option schemes in place.

A fantastic platform. The price is fixed. The customer support is fantastic and readily available. They have held our hand right through the whole process.

I love Vestd and I wish I had found it sooner. It makes the whole process of issuing shares whether they're growth shares or ordinary shares incredibly simple.

Amazing shift from Excel to Vestd. The support team were amazing and did a great job of completing our setup and we have been very pleased at being able to better manage our governance over time.

Frequently asked questions

-

What is a cap table?

The cap table is a legal document that captures your startup’s capital structure. It spells out shareholder details, financing rounds, and other information about your company’s equity ownership and accompanying rights.

We’ve created a cap table template that you’re welcome to download but a digital cap table is way better.

-

Why is a cap table important?

Maintaining an accurate and up-to-date cap table shows the business’ growth potential. It particularly helps:

- Improve visibility

- Increase investor and stakeholder confidence

- Influence data-driven decision-making

And with staying compliant

-

What should a cap table look like?

Comprehensive and up-to-date. Some startups choose to initially build and store cap table information in a spreadsheet. However, over time it becomes harder to keep up with the complexity of a growing business, and can lead to mistakes in your cap table.

If your startup is looking to hire key recruits or raise a new round of funding, an automated, purpose-built solution is the way to go. A digital cap table offers more flexibility, saves you time spent on collating and consolidating information, and custom access for relevant stakeholders.

-

Do investors see the cap table?

Yes. A cap table is built to help shareholders visualise and understand their position in the business. Cap table transparency helps potential investors determine the leverage they can get for their investment in the business. Here are some things investors look for in a cap table.

-

Can employees see the cap table on Vestd?

Not if you don’t want them to. There are no legal requirements stating that the cap table ought to be public. You can choose to share your cap table with relevant shareholders.

-

Does a cap table include options?

Yes. A good cap table captures information about all shares and options granted, exercise price, and any other additional information pertaining to options.

-

Should a cap table include debt?

Early stage businesses raise capital in a variety of ways that can be in the form of equity or debt (convertible or straight). This information needs to be recorded in the cap table to help potential investors understand the financial health of the business.

-

Who should manage the cap table?

Traditionally, businesses seek legal counsel to help manage their cap table. However, it is a costly route. A digital cap table can save you time and money, particularly as the business scales.

Moreover, a cap table platform makes it easier to consolidate and present information to investors when you’re looking to raise capital.

© 2026 Vestd Ltd. Company number 09302265. Registered in England and Wales.

Vestd Ltd is authorised and regulated by the Financial Conduct Authority (685992).

Registered office: Suite LU.231, The Light Bulb, 1 Filament Walk, Wandsworth, SW18 4GQ.