How do I register a new Growth Share or Unapproved Option Scheme with HMRC for Employees?

Before you can submit your annual return to HMRC, you first need to register the scheme.

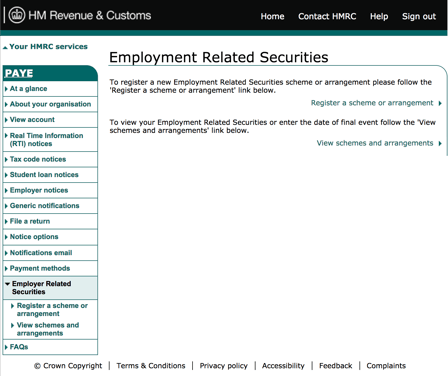

Registering a scheme (whether unapproved options or growth shares) is completed through HMRC's Employment Related Securities (ERS) system.

If you already have an HMRC account with PAYE set up, log in here and follow the steps below.

Important: If you don’t have PAYE on your account already, please note that it can take up to 3 weeks to set up. There’s also a delay of around 24 hours between registering a scheme and being able to complete the notification. So be sure to leave enough time to carry out the notification before the deadline.

If you need help adding PAYE to your account, watch this video from HMRC.

- Once you have logged in, locate the ERS link.

- Once you are in the ERS system select Register a scheme or arrangement.

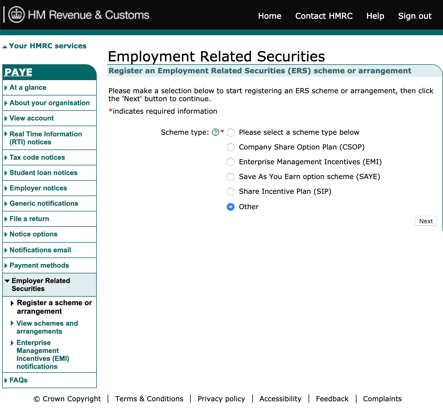

- Then select Other

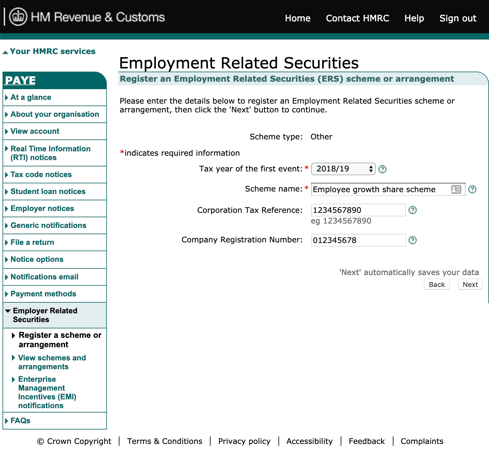

- You need to select the tax year - this is going to be the tax year the shares or options were first issued.

- You also need to enter a scheme name, this can be anything you want and acts as a reference for you.

- Please note, if this is for Unapproved Options, this scheme can be used for all future Unapproved Options, so you can call the scheme 'Unapproved Options'

- If this is for Growth Shares, you will need to register a new scheme for any future Growth Shares. If this is the case, we recommend you call the scheme 'Growth Shares 2023/24'

- The corporation tax reference and company number should be filled in automatically, but if not you should enter these.

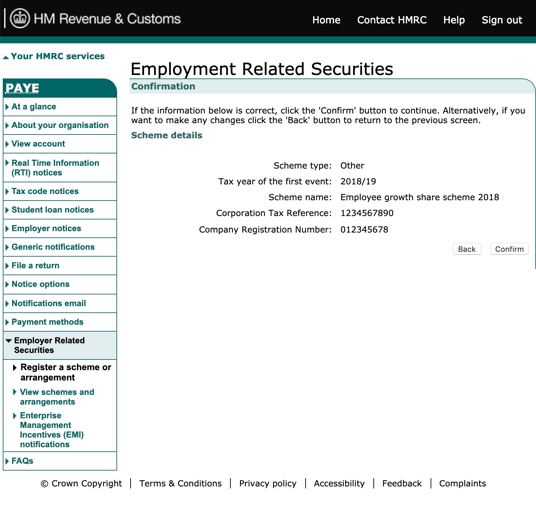

- The next page will give you a summary of the entered information and the opportunity to go back and make any changes. Once you're happy, click Confirm

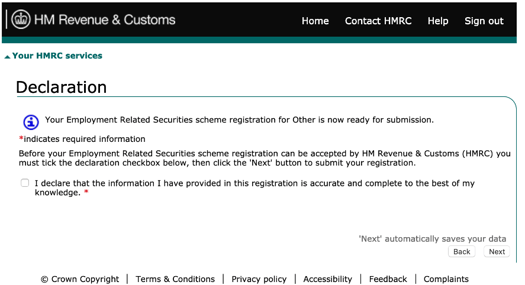

- The next page will be a declaration screen, where you need to confirm the information you have submitted is correct. Tick the box and click Next.

- Please note, you may be logged out after this. Re-enter your login details to confirm the submission

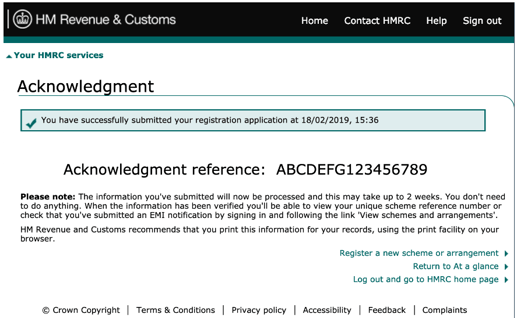

- Finally, an acknowledgement screen is displayed with a reference number.

- Once this request has been processed, the scheme will be set up and the annual notification can be made.

- It can take around 24 hours for HMRC to process this. You can check on the progress by logging back in

- Once HMRC have processed your scheme, you can follow this guide to complete the notification

Our team, content and app can help you make informed decisions. However, any guidance and support should not be considered as 'legal, tax or financial advice.'