The benefits of issuing EMI options using a growth share class

How companies can avoid exceeding EMI limits and reduce the exercise price for employees.

EMI schemes are tax advantageous for both companies and employees. But there are limits to the value of EMI options a company can issue before being disqualified and losing the tax benefits.

- Any individual employee can receive up to £250,000 in shares within a 3-year period, based on the UMV (unrestricted market value) at the point of grant.

- The company can grant up to £3m in unexercised options at any one time, based on UMV at the point of grant.

For larger companies with higher UMVs, these EMI limits can approach fast when issuing relatively small percentages of options to many employees, or large amounts to a few.

However, if you issue EMI options using a growth share class (as opposed to ordinary shares), it’s unlikely that you’ll ever reach the maximum limits.

That’s because growth shares are always issued at nominal value (the face value of a share, as determined by how the company’s capital is denominated) or close to.

In short, growth shares are worthless upon issue (and at the time they're granted as options), as they have a ‘hurdle rate’ attached to them, which is higher than the current value of ordinary shares. The hurdle rate represents the value of the company at that point in time, plus a small premium (usually 10%-40%) to reflect a future ‘hope value’ of the company. Recipients of growth shares only benefit from the increase in share value from the hurdle rate onwards. This protects ordinary shareholders from dilution.

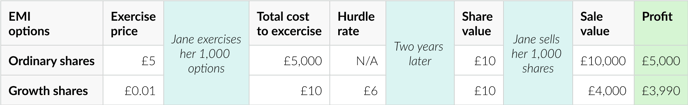

For example, Acme Ltd. wants to distribute 1,000 EMI options to each of its 200 employees. Here’s how that could look when issuing the options over an ordinary share or growth share class:

Using ordinary shares quickly eats away at the EMI allowance and can impact future distributions, like if a company wants to offer a large EMI package to a new director.

Following on from the Acme example above, recipients of EMI options would have a hurdle rate attached to their growth shares, let’s say £6. So the first £6 on any eventual sale is reserved for ordinary shareholders, which protects them from dilution and respects the work they’ve done to grow the business to that point.

Another benefit of issuing EMI options with a growth share class is the significantly lower exercise price for recipients.

When an employee receives EMI options over an ordinary share class, they will have to pay an exercise price (usually set at the AMV, which in the Acme example above would be £5 per share) to exercise their options. Exercising 1,000 options would cost £5,000.

Whereas the exercise price for growth shares is always nominal value, or close to.

Here’s an example of how an EMI options scheme can play out from the point the options were issued to the eventual sale of shares.

To summarise, issuing EMI options over a growth share class can remove the limitations of EMI and allow larger companies to distribute thousands of EMI options to many employees.

It also lowers the cost of entry for employees by removing high exercise prices, which is great if you’re issuing EMI options to low-paid workers. And of course, employees and companies will benefit from the tax advantages of EMI.

Our team, content and app can help you make informed decisions. However, any guidance and support should not be considered as 'legal, tax or financial advice.'