What is a Nominee Structure?

Vestd Nominees help keep your cap table tidy by separating legal and beneficial ownership.

Nominee Structures make use of the ability to separate legal and beneficial ownership.

The separation of ownership in English law can be traced back to medieval times and the ownership of land and property - but we’ll spare you the details for now.

By allowing shareholder ownership to be separated in this way, using a Nominee Structure can help simplify your cap table. It allows one entity to legally own the shares, whilst another entity (such as a group of investors) can benefit from those shares, by having rights to capital, dividends, and/or voting.

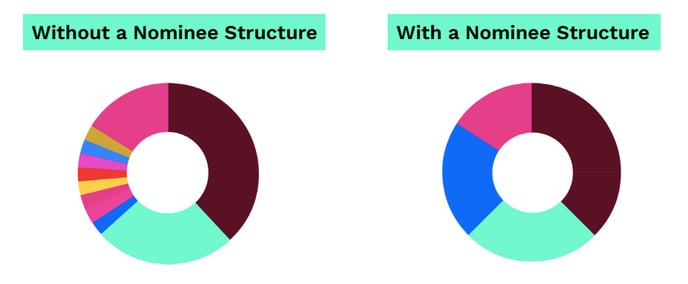

On your cap table, using a Nominee Structure enables many names to be held under the one label of a shareholder nominee. This nominee company holds shares on behalf of a person, or group of people.

Vestd Nominees

The Vestd Nominee Structure enables the legal owner and beneficial owner of shares to be separated, which allows for multiple people to reap the benefit of those shares, whilst only one name - “Vestd Nominees” - is shown on the cap table.

Why use a Nominee Structure?

Using a Nominee Structure helps keep your cap table clean, which is particularly important for attracting investment.

Ahead of raising early-stage investment, be this a Friends and Family round, or through crowdfunding, you might want to set up a Nominee Structure to keep your cap table neat and tidy.

It’s important to maintain a clear, well-organised, and up-to-date cap table ahead of pursuing angel or venture capital investment.

This is because investors may make snap judgements that can influence whether or not they decide to invest in your startup after a quick glance at your cap table, such as how many investors are already involved, or who holds what proportion of voting rights.

Using a Nominee Structure can also help preserve the anonymity of particular investors, should they be this way inclined.

This is because your cap table is a key element that potential investors can use to get a quick insight into your company, such as how many other investors are already involved, or the spread of voting rights.

To put your best foot forward, it can be useful to use a nominee structure where there are many shareholders or micro-investors.

A Nominee Structure can also be used to preserve the anonymity of a shareholder, where the beneficial owner wants to remain private.

How do I set up a Nominee Structure?

You can set up a Nominee Structure whilst on any plan at Vestd.

If you want to use the Vestd Nominee Structure, please contact us to set it up for you.

Our team, content and app can help you make informed decisions. However, any guidance and support should not be considered as 'legal, tax or financial advice.'