Adopting the Vestd Articles of Association

The second step to setting up a Growth Share scheme.

Once the hurdle valuation process has begun, but before you can authorise a Growth Share pool, and later issue Growth Shares, you'll need to know whether your company's Articles of Association are suitable for Growth Shares. If you are unsure, or if your company does not use the Model Articles, just get in touch with our team at support@vestd.com, and we will point you in the right direction.

If your company adopted the Model Articles on incorporation, and has not made any amendments, you can easily follow the process of adopting the Vestd Articles of Association through the platform.

Watch this video for steps on how to adopt the Vestd Articles of Association if your company is on Model Articles.

What these Articles contain is explained further down. Don't worry, you will have the chance to review everything before you commit.

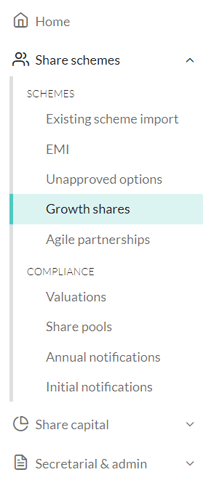

First, log onto the platform and go to Share schemes > Growth shares:

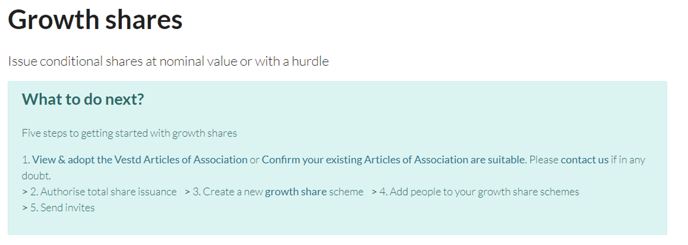

Which will take you here:

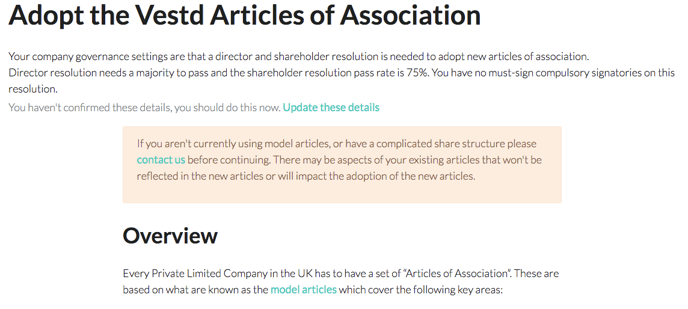

Clicking View & Adopt the Vestd Articles of Association will take you to the following page, outlining your Company Governance settings (in case you need to change them before sending out the resolutions), and giving you an overview of our Articles:

The page explains everything in a little more detail, but the gist is this:

- These are based on British Venture Capital Association’s template articles of association, which are adopted by many early stage companies;

- They have been adapted by our lawyers;

- The Articles have been drafted with the intention that existing or future SEIS & EIS shareholders will not be impacted, with respect to meeting HMRC qualifying criteria. Please check with your lawyers if you have any concerns about these being right for you;

- The Articles include “drag along and tag along” clauses in case of an exit. This ensures that any minority shareholders will have the right to be bought out in the case of the company changing hands, and the company can ensure that they are bought out, if they so want;

- The Articles are drafted to limit any issues in the event of a non-cash acquisition of the company, such that the purchase to go ahead without problem (Article 20);

- They allow you to issue conditional growth shares as well as options or ordinary shares;

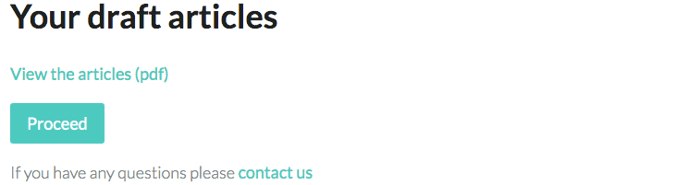

At the bottom of the page, you will find a link to the Articles themselves, right above the Proceed button:

Feel free to download these and read through, or show these to your lawyers to make sure there are no aspects of your existing articles that won't be reflected in these new ones.

If you are happy to move ahead, just click Proceed at the bottom of the page. This will send the relevant resolutions to the Directors and Shareholders, and you will be notified when these have passed. Companies House will be automatically updated.

That's the wordy bit done. Once the resolutions have passed, or you have confirmed to us that your Articles are suitable for Growth Shares, you can go ahead and authorise the Growth Share pool.

Our team, content and app can help you make informed decisions. However, any guidance and support should not be considered as 'legal, tax or financial advice.'