The original share scheme & equity management platform

No paperwork, no headaches, no hassle.

Book a call

Select an option below:

- For companies

- For investors

- For accountants

Our platform is fully integrated with Companies House and will transform the way you share, manage and track ownership. Vestd is directly authorised and regulated by the FCA.

Invite and add portfolio companies to the platform for real-time insight and assurance. Vestd is the single source of truth that is reflected at Companies House.

Manage your client portfolio with ease from a single dashboard. Our powerful company secretarial tools will help you eliminate hassle and paperwork.

How Vestd works for companies:

How Vestd works for investors:

How Vestd works for accountants:

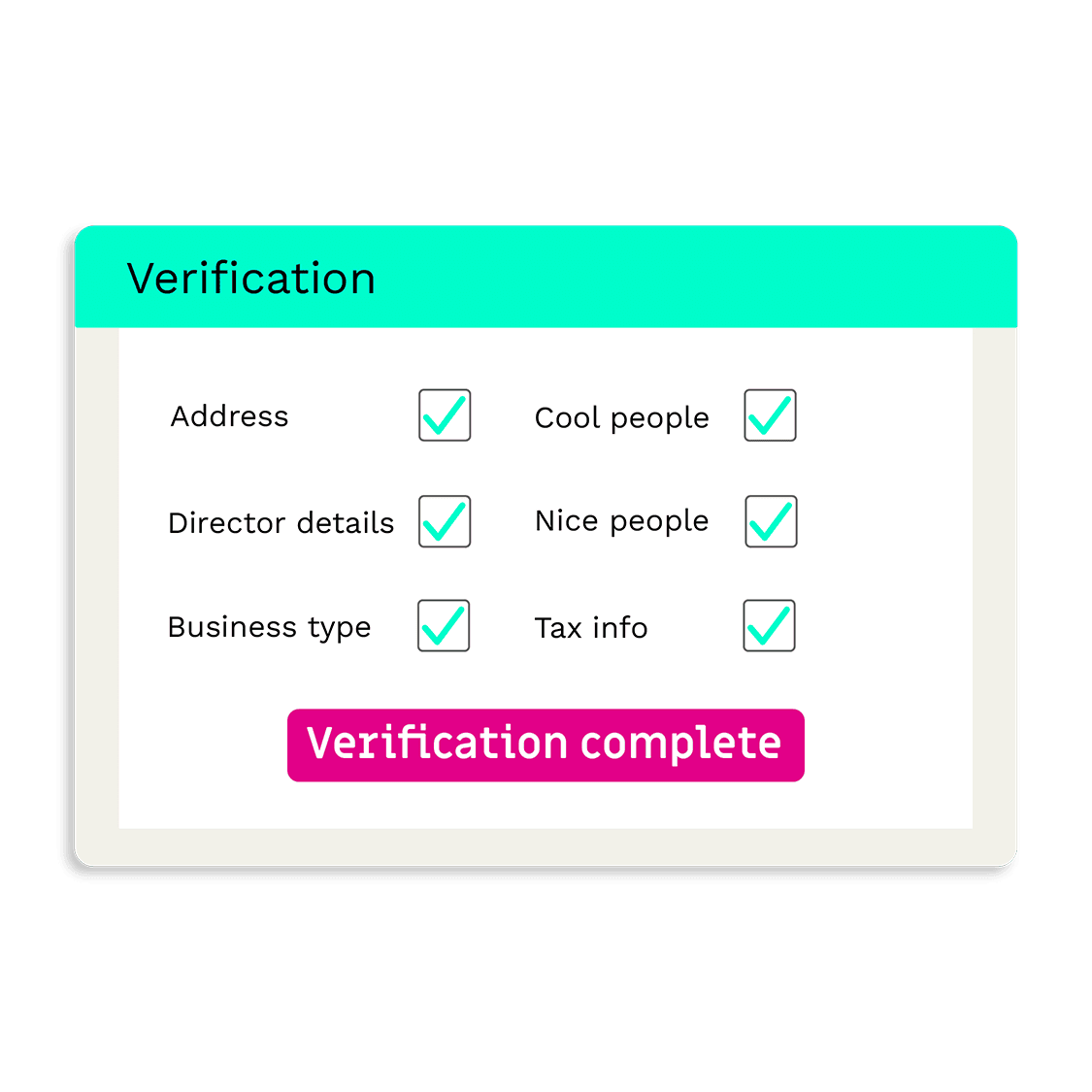

Connect Vestd to Companies House to see your ownership structure. We will find and fix any cap table issues.

View existing shareholders, add new ones, launch a company share scheme and manage your equity via the platform.

Provide shareholders with personal dashboards so they can watch their stakes grow.

Request access to companies already on our platform.

Add other investments and invite portfolio companies to join.

Value your portfolio at a glance, as a whole or by entity.

Digitally manage client equity, shareholders and company filings.

Add a string to your bow by launching and managing share schemes for clients.

Secure preferential rates for your client base.

Company share schemes

Sharing success makes for a stronger business. Design and launch a share scheme with ease.

Powerful CoSec tools

Wave goodbye to manual filing thanks to our comprehensive Companies House integration.

Equity management & CoSec

Manage equity, shareholders and all company secretarial activity directly via the platform.

Total equity management

Issue shares for clients and manage shareholder records, directly via the platform.

Company valuations

Our in-house analysts will produce up to four valuations a year, at no extra cost.

Digital cap tables

Maintain an accurate record of company ownership, with share movements reflected at Companies House.

Share schemes

Design, launch and manage company share schemes with the help of our experts.

Funds & syndicates

Set up Special Purpose Vehicles to create and manage Syndicates, Pledge Funds and Managed Funds.

Legal documents & templates

Share scheme legal docs are provided, as well as business document templates.

S/EIS Advance Assurance

The most founder-friendly way to secure S/EIS Advance Assurance, with guidance from our team.

Recipient dashboards

Shareholders are provided with personal dashboards to track the value of their stake.

Trusted by thousands of companies

Share schemes made easy

Launch a new scheme or digitise an existing one to build a team that is all-in.

EMI Schemes

Enterprise Management Incentives are the most tax-efficient way of rewarding employees with equity.

Unapproved Options

Flexible and quick to set up, Unapproved Options can be issued via the platform to employees and non-employees.

Growth Shares

Recipients of Growth Shares benefit from growth in company value from the time at which they are issued, minimising dilution for existing shareholders.

Company Share Option Plans (CSOPs)

Digitise an existing Company Share Option Plan or launch a new one, via our guided service.

Agile Partnerships

Reward people based on what they actually bring to the party by setting up an Agile Partnership. Ideal for co-founder equity or to transform established businesses.

What Vestd can do for your business

We support businesses of all shapes and sizes, in a wide range of sectors.

Manage ownership easily

Vestd is the only platform you need, no matter where you are on your equity journey.

Launch

- Company incorporation

- Articles of Association

- Issue shares & certificates

- Digital cap table

- Co-founder equity

Raise

- S/EIS Advance Assurance

- Funding rounds

- Secure data room

- Shareholder dashboards

- Scenario modelling

Grow

- Company share schemes

- Company valuations

- EMI schemes

- Growth shares

- Unapproved options

Mature

- Equity management

- Company secretarial

- Digitise EMI & CSOP

- Shareholder comms

- Compliance

Cash out

- Share transfers

- Share buybacks

- Agile Partnerships

- Share scheme exit support

- EOT & succession

Why choose Vestd?

Save time

No more paperwork! No more manual filing or spreadsheets. No more human errors or friction.

FCA authorised

Vestd is directly authorised and regulated by the Financial Conduct Authority.

Full service

Our equity specialists will provide plenty of hands-on support if you need it.

Save money

Pricing is typically a fraction of what you'd normally pay via traditional providers.

Five star service

Our team of 70+ experts help people every day and have had some amazing customer reviews and ratings.

As seen in the press

The platform itself allows you to manage all aspects of share and option management concisely in one place. The automations and integrations save you time. But while the platform is great, it is the team that makes Vestd stand out. From pre-sales to onboarding and the ever-helpful support team - not only do they support on the platform but provide excellent knowledge in this area.

Great platform. The team always provide brilliant support. I would definitely recommend using Vestd to anyone who needs to set up and administer an EMI scheme.

Straight forward and structured approach - so good for founders and also FD/CFO/advisor who is looking to get share capital and share option schemes in place.

A fantastic platform. The price is fixed. The customer support is fantastic and readily available. They have held our hand right through the whole process.

I love Vestd and I wish I had found it sooner. It makes the whole process of issuing shares whether they're growth shares or ordinary shares incredibly simple.

Amazing shift from Excel to Vestd. The support team were amazing and did a great job of completing our setup and we have been very pleased at being able to better manage our governance over time.

Talk to a specialist

We'd love to learn about your business and goals, and demonstrate how our platform will transform the way you share, manage and track ownership.

Frequently asked questions

-

How many shares should I give to people?

This is one of the first questions you will face. Three things to figure out:

- How much of my company equity should I set aside for the scheme?

- How many shares should each team member receive?

- How do I manage dilution as new team members join the scheme?

-

What is a vesting schedule?

When you award options to employees they don’t become available to them immediately. Instead, the options go through a ‘vesting’ period, and become available over time.

No prizes for guessing where our brand name comes from!

-

When can my team access their shares?

Real shares are granted immediately, but options are subject to vesting, and that comes in two distinct forms: exit-only or exercisable. We are huge fans of the latter for all sorts of reasons, but most companies choose the former.

-

What kind of conditions can I set?

Some schemes can be conditional... and you decide what the conditions are.

Options schemes are usually aligned to time-based vesting over a period of years, but you can also set performance milestones.

EMI option schemes and Agile Partnerships are both perfect vehicles for conditional equity rewards.

-

How should I price my shares?

This depends on how you want to distribute equity (e.g real shares, growth shares, or options). There are tax implications for each of these methods.

For EMI options schemes you have a choice to make: you can allow employees to exercise the options at the nominal value, or at an agreed actual market value. The former incurs income tax, whereas there is no tax owed on the latter. Or perhaps the exercise price will be somewhere in between these two values?

This can be a lot to get your head around, so if you want to talk it through then just schedule a no-obligation call with one of our equity experts.

-

What happens if someone leaves?

As a business owner you have plenty of protection in the event that an individual leaves or doesn’t deliver, so long as the right conditions are in place.

However, it’s important for the equity to create the desired impact and incentive. That means the recipient also needs to feel that the criteria is fair.